Search Arizona Property Records

Arizona property records give you facts about land and real estate across the state. Each of the 15 county recorder offices keeps deeds, liens, mortgages, and other title documents on file. You can search these records online through county databases or visit a recorder office in person. The state also tracks property tax data and land use through the Arizona Department of Revenue and State Land Department. Whether you need to check who owns a parcel, find a recorded deed, or look up a lien, Arizona makes most property records open to the public.

Arizona Property Records Quick Facts

Arizona County Recorder Offices

Property records in Arizona are kept at the county level. Each county has a recorder who stores deeds, mortgages, liens, and other land documents. The recorder must accept and file any paper that meets state rules. Once filed, the document becomes part of the public record. Anyone can search or get copies of these records.

The Arizona State Land Department handles records for state trust lands. This agency manages over 9 million acres in Arizona. If you need info on state land parcels, leases, or permits, the ASLD can help. Their office is at 1110 West Washington Street in Phoenix. You can call them at 602-542-4631 during business hours.

The ASLD also runs a parcel viewer for state trust lands. This tool lets you search maps and find land use data online.

Under A.R.S. 11-461, the county recorder must keep all records, maps, and papers in their custody. The law says the recorder shall record each instrument that state law requires or allows. Records can be kept in many forms. These include typewritten copies, photos, and digital files. Most counties now scan documents and store them on computer systems.

Note: Each county recorder sets their own hours and service options, so check with the local office before you visit.

Property Recording Fees in Arizona

Arizona sets recording fees by state law. As of July 2019, all counties charge flat fees rather than per-page rates. A.R.S. 11-475 lists the exact amounts. A standard document costs $30 to record. Government agencies pay $15 per document. Plats and surveys have a first page fee of $24 plus $20 for each extra page. Copies cost $1 per page. A certified copy adds $3 to the total.

These fees apply at every county recorder office in Arizona. The flat fee system makes costs easy to predict. You pay the same rate whether your deed is one page or ten pages. Only plats and surveys still use a per-page model.

Most Arizona counties accept cash, checks, and credit cards. Some charge a small fee for card payments. E-recording through vendors like Simplifile or CSC may have extra service charges. Call your county recorder to confirm payment options before you submit documents.

Arizona Property Document Rules

Documents must meet certain standards before a recorder will accept them in Arizona. A.R.S. 11-480 spells out the form rules. Every document needs a caption at the top that states what type of paper it is. For a deed, the caption might say "Warranty Deed" or "Quitclaim Deed." This helps clerks sort and index records correctly. The paper must be an original and clear enough to copy. Faded or hard to read pages may be rejected.

Margin rules also apply. Documents signed after January 1, 1991 need at least half an inch of blank space on all sides. The top of the first page must have a two inch margin for the recorder to stamp filing info. Deeds of trust and mortgages for one to four family homes must include the words "RESIDENTIAL 1-4" in the caption. This tag helps track residential loans in the system.

Arizona law requires most deeds to include an affidavit of legal value. Under A.R.S. 11-1133, the seller and buyer must state the sale price on a form attached to the deed. The recorder will refuse to file a deed without this paper unless the transfer qualifies for an exemption under A.R.S. 11-1134. Common exemptions include gifts between family members and transfers to trusts.

Deeds and Conveyances in Arizona

A.R.S. 33-401 sets the formal rules for deeds in Arizona. Every deed must be signed by the grantor, which is the person giving up ownership. The signature must be notarized before an authorized officer. If the buyer is a company regulated under Title 6, 10, or 29, the deed must list the company name, address, and state where it was formed. These rules help make sure property transfers are valid and can be traced.

Deeds come in several types. A warranty deed offers the most protection. The seller promises clear title and will defend against any claims. A special warranty deed only covers the time the seller owned the land. A quitclaim deed transfers whatever interest the seller has but makes no promises about title. Each type serves a different purpose in Arizona real estate deals.

Why Recording Matters in Arizona

Recording a deed or lien does more than store a paper. It gives public notice of your rights. A.R.S. 33-411 says an unrecorded document does not give notice to later buyers. If you buy land but do not record your deed, someone else could claim they did not know about your purchase. Recording protects you against these disputes.

A.R.S. 33-416 confirms that a properly recorded document serves as notice to everyone. Once filed, the law treats all people as if they knew about the document. This is called constructive notice. It means you cannot claim ignorance of a recorded lien or deed in Arizona. Title searches rely on this system. A buyer can check the records and trust that any claims against the land will show up.

Note: Always record important property documents as soon as possible to protect your ownership rights in Arizona.

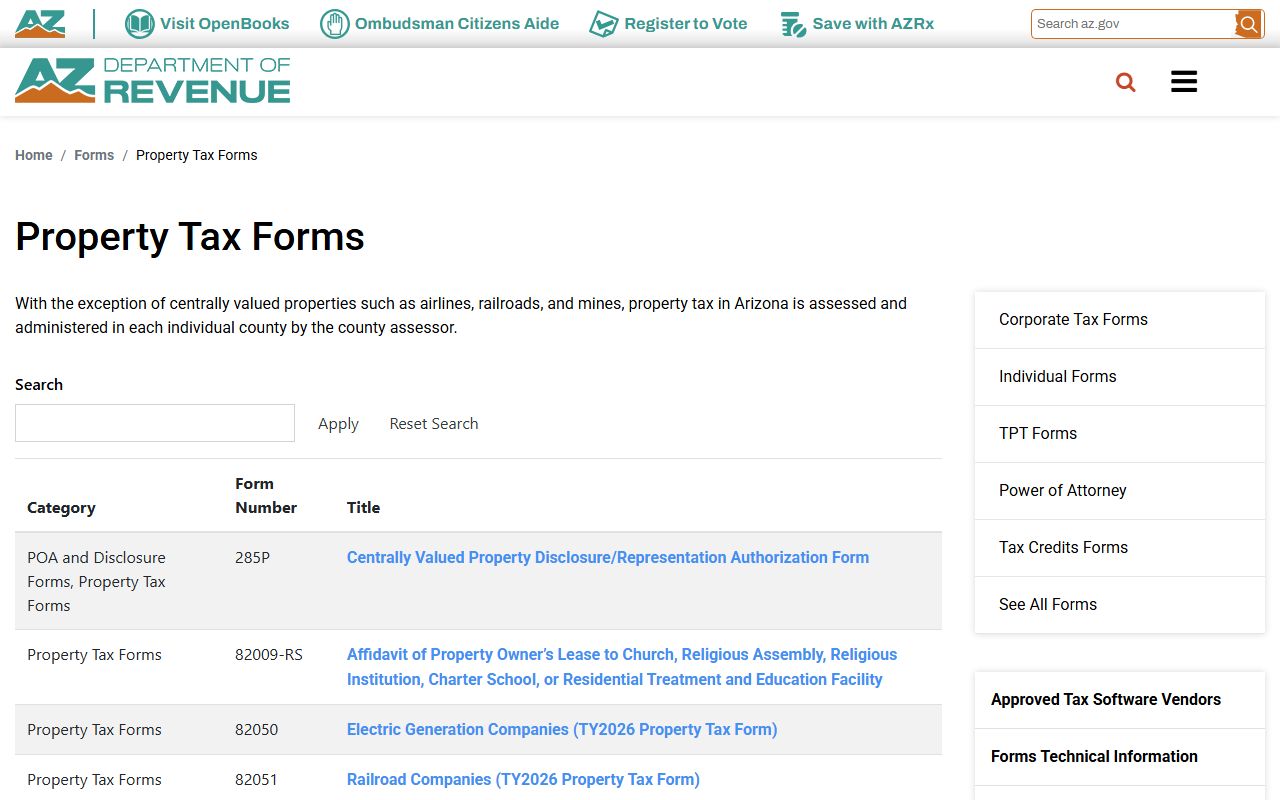

Arizona Property Tax Records

The Arizona Department of Revenue oversees property tax rules across the state. Each county assessor values real and personal property for tax purposes. The county treasurer collects and distributes the taxes. Arizona uses these funds for schools, local government, and special districts. The ADOR website has forms, guides, and contact info for property tax questions.

Property taxes in Arizona follow a two-payment schedule. The first half is due October 1 and becomes late after November 1. The second half is due March 1 and becomes late after May 1. If you miss a payment, interest and penalties start to add up. After several years of unpaid taxes, the county may sell a tax lien on your property.

You can find property tax forms on the ADOR site. These include appeal forms, exemption requests, and reporting documents. If you think your property value is wrong, you can file an appeal with your county assessor. Use ADOR Form 82130 for real property and Form 82530 for personal property. Appeals must be filed within 60 days for real property or 30 days for personal property after you get your notice.

How to Search Property Records in Arizona

Most Arizona counties offer online search tools for property records. These databases let you look up deeds, liens, and other documents from home. You can search by owner name, parcel number, or address. Some counties charge a fee to view full document images. Others let you see basic index info for free.

Maricopa County has one of the largest online systems. Their recorder office holds over 50 million searchable documents going back to 1871. You can search by name, legal description, address, or subdivision. The database at recorder.maricopa.gov is free to use. Document images and certified copies cost extra. Pima County offers a similar public search at recorder.pima.gov/PublicSearch where you can view records from their downtown Tucson office.

To search Arizona property records, you will need some basic info:

- Owner name or names on the deed

- Parcel number or address of the property

- Approximate date of recording

- Type of document you are looking for

- County where the property is located

In-person visits work well when you need help or want certified copies. Go to the recorder office in the county where the land sits. Staff can assist with searches and make copies on the spot. Most offices are open Monday through Friday during business hours. Some counties have branch locations in other cities for convenience.

E-Recording in Arizona

Arizona allows electronic recording of property documents. Title companies, lenders, and attorneys use this service to file papers without visiting the recorder office. Over 90 percent of documents in Maricopa County now come in through e-recording. The process is fast and cuts down on mail delays.

Several vendors offer e-recording services in Arizona:

- Simplifile for document submission

- CSC for title and mortgage filings

- eRecording Partners Network

These vendors charge service fees on top of county recording fees. Contact your county recorder for a list of approved e-recording partners. Not all document types can be filed online. Some papers still need to be mailed or brought in person.

Note: E-recording is mainly used by professionals, but individuals can ask a title company to file documents on their behalf.

Browse Arizona Property Records by County

Each county in Arizona has its own recorder office that keeps property records. Pick a county below to find local contact info and online search tools.

Property Records in Major Arizona Cities

Residents of major cities file property documents at their county recorder office. Pick a city below to learn about property records in that area.