Find Mohave County Property Records

Mohave County property records include deeds, mortgages, liens, and other land documents stored by the County Recorder in Kingman. This northwestern Arizona county spans over 13,000 square miles along the Colorado River. You can search these property records online through the recorder's website or visit offices in Kingman, Bullhead City, or Lake Havasu City. The recorder's office serves all residents of Mohave County for recording and public document access. Whether you need to verify ownership, find liens, or research a property's title history, Mohave County provides several ways to access these records.

Mohave County Quick Facts

Mohave County Recorder's Office

The Mohave County Recorder's Office handles all property document recording in the county. Lydia Henry serves as the current recorder. The main office is at 700 West Beale Street in Kingman. You can call them at (928) 753-0701. The recorder's office serves all residents of Mohave County for recording, voter registration, and early ballot functions.

Mohave County has three office locations to serve its large geographic area. The main office in Kingman handles most recording. The Bullhead City office is at 1130 Hancock Rd, and you can reach them at (928) 758-0701. The Lake Havasu City office is at 2001 College Dr, Suite 93, phone (928) 453-0702. This makes it easy to access services no matter where you live in the county.

Staff will record documents that meet state requirements. They will not provide legal advice or help you fill out forms. If you need a deed, quit claim, or other document prepared, you must get that done elsewhere. The office does not draft documents for the public.

Note: Mohave County currently has over 158,000 registered voters, making the recorder's office busy with both property recording and election duties.

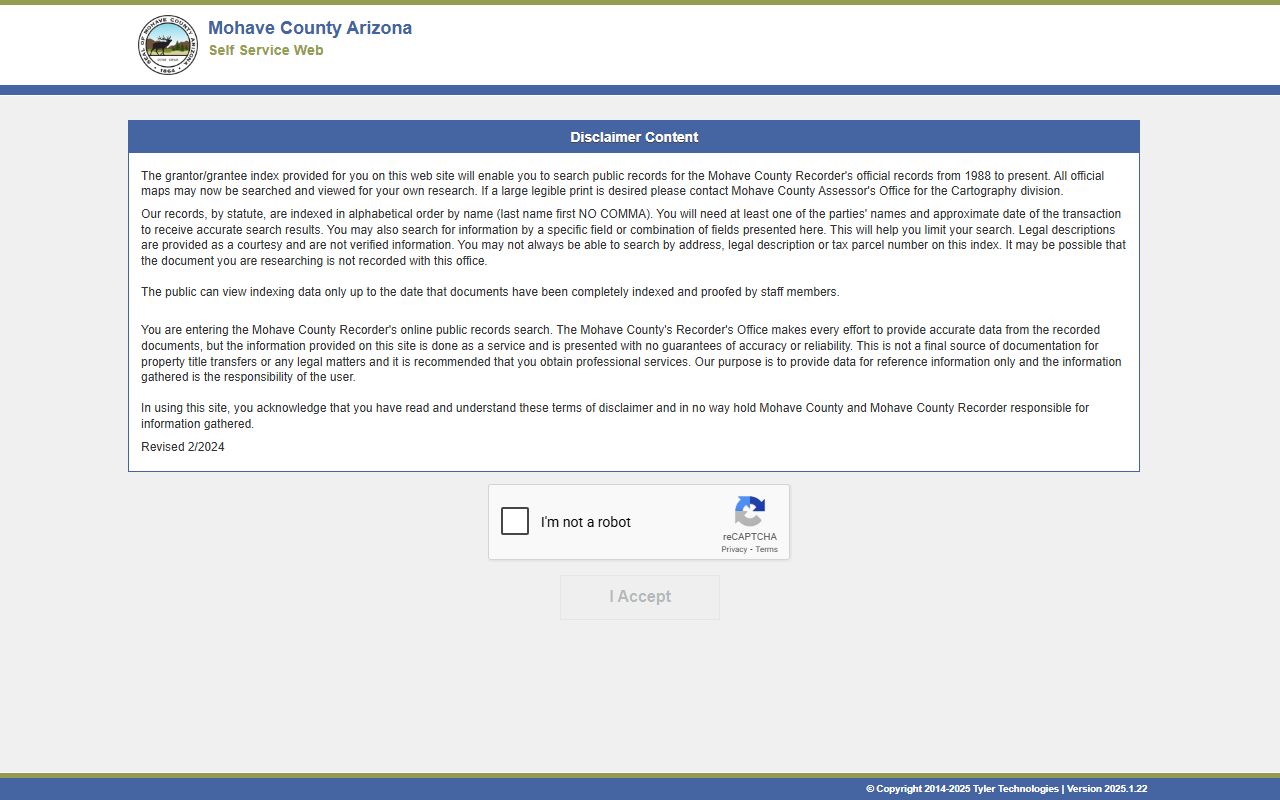

Mohave County Property Document Search

You can search recorded documents through the Mohave County document search portal. The database lets you look up property records by name, document number, recording date, or other details. Basic searches are free to use.

The online search gives you basic info and often preview images of documents. You can find deeds, mortgages, liens, releases, and other recorded papers. For certified copies, you may need to contact the office directly or submit a mail request. Copies cost about $1.00 per page under state rules.

Mohave County also offers a fraud alert service through the Document Alert system. You can sign up to get notified when a document is recorded against your property. This helps catch fraudulent deed transfers or liens before they cause damage. The alert system sends you notice whenever a new document is filed with your name.

Recording Fees in Mohave County

Mohave County follows the state fee schedule for recording under A.R.S. 11-475. A standard document costs $30.00 to record. This flat fee applies to most deeds, mortgages, releases, and other common papers. The fee structure changed in 2019 from per page to flat rate.

Government agencies pay $15.00 per document when they request the recording. Plats and surveys have a different fee structure. The first page costs $24.00 to record. Each additional page costs $20.00. This applies to subdivision plats, lot splits, and survey maps.

Your deed must include either an Affidavit of Property Value or an exemption code to be accepted for recording in Mohave County. This is required under A.R.S. 11-1133. Without this form, your document will be rejected and returned. Common exemptions include transfers between family members, transfers into trusts, and certain court ordered transfers.

Mohave County Property Assessor

The Mohave County Assessor values real and personal property for tax purposes. Jeanne Kentch serves as the current assessor. You can reach the office at (928) 753-0703. The assessor looks at each property and sets its assessed value, which determines property tax amounts.

The assessor's office can help you understand your property's value. Property values are set each year based on market conditions and property characteristics. If you disagree with your assessed value, you can file an appeal. Use ADOR Form 82130 for real property appeals. Appeals must be filed within 60 days of your notice of value.

The assessor and recorder are separate offices. The recorder handles document filing and storage. The assessor handles property valuation for tax purposes. Both offices work with property records in Mohave County, but they have different jobs.

Property Taxes in Mohave County

The Mohave County Treasurer collects property taxes. You can reach them at (928) 753-0737. Taxes are paid in two parts each year. The first half is due October 1 and becomes delinquent after November 1. The second half is due March 1 and becomes delinquent after May 1. These dates are set by state law.

Missing a payment leads to interest and penalties. The state charges interest on late taxes. If property taxes go unpaid for several years, the county can sell a tax lien on the property. Investors can purchase these liens and earn interest when the property owner pays.

You can pay taxes online through the Mohave County tax payment portal. Tax records show the payment history for any property in Mohave County. You can use this info to verify a property is current on taxes before buying it.

Note: Always check tax status before purchasing property to avoid inheriting unpaid tax liens.

Mohave County GIS Maps

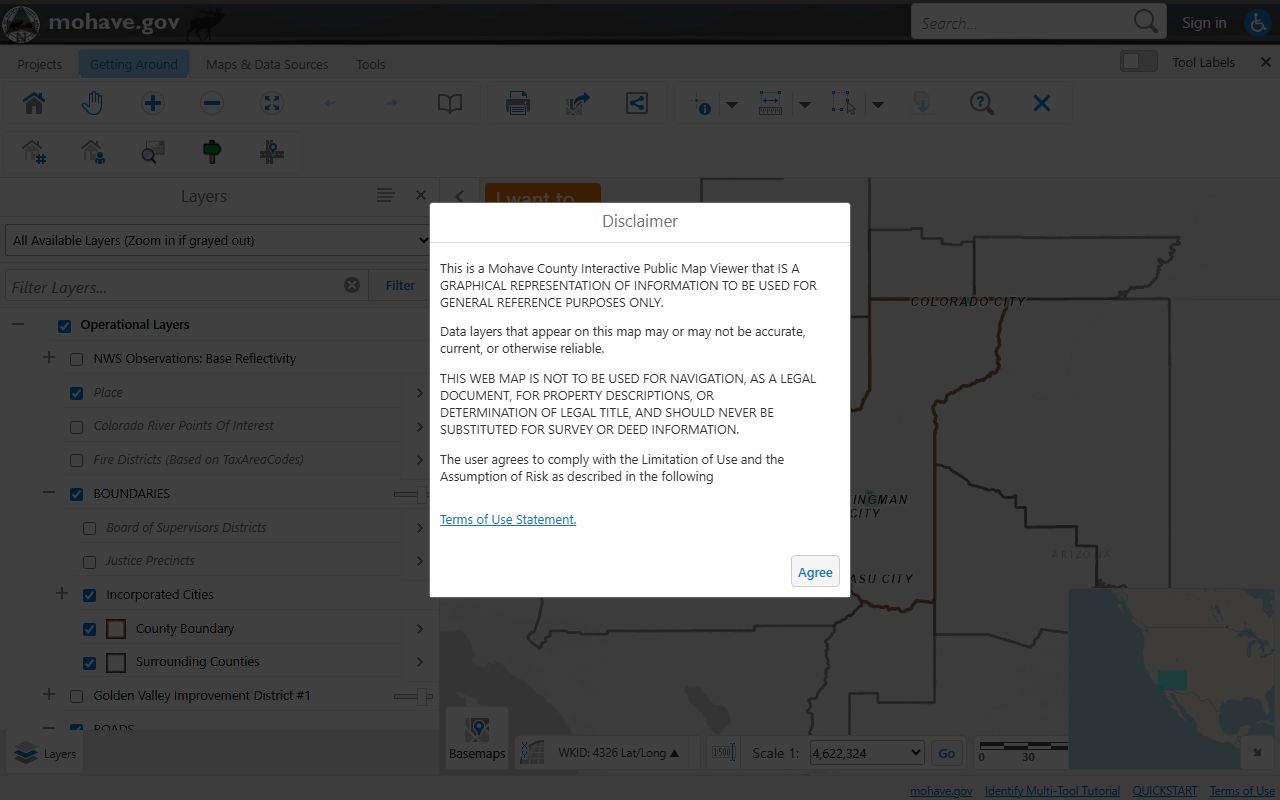

The county provides GIS mapping tools for property research. The Mohave County Public Map Viewer offers parcel boundaries, zoning layers, and other geographic data. These maps show property lines, subdivisions, and land features across the county.

You can also find mapping data through the Mohave County Open Data Hub. These tools let you view aerial photos, search parcels, and explore land use data in Mohave County. The maps are useful for property research, development planning, and understanding neighborhood boundaries. You can overlay different data layers to see zoning, flood zones, and more.

GIS data complements the official property records at the recorder's office. Maps show where a property is located. Recorded documents prove who owns it. Both are needed for a complete picture of any property in Mohave County.

Arizona Property Recording Laws

Arizona law sets the rules for recording property documents in Mohave County. Under A.R.S. 11-461, the county recorder has custody of all records, maps, and papers deposited in the office. The recorder must keep these documents safe and make them available for the public to search.

Documents must meet certain form requirements to be recorded. Under A.R.S. 11-480, each document must have a caption that briefly states what it is, such as warranty deed or release of mortgage. The first page needs a two inch top margin for recording stamps. All sides need at least a half inch margin.

Recording protects your property rights. Under A.R.S. 33-411, an unrecorded deed does not give notice to future buyers or lenders. Someone could claim they did not know about your ownership if you fail to record. Once recorded, your document gives legal notice to everyone per A.R.S. 33-416.

Cities in Mohave County

Mohave County contains several cities and towns along the Colorado River corridor. Property recording for all of them goes through the Mohave County Recorder. The main office is in Kingman, but satellite offices in Bullhead City and Lake Havasu City make access easier for residents.

Lake Havasu City is one of the largest cities in Mohave County. It is known for the London Bridge and popular water recreation. Property records for Lake Havasu City are filed at the Mohave County Recorder's Office. The City of Lake Havasu Planning and Zoning department handles permits and development within city limits.

Other communities in Mohave County include Kingman, Bullhead City, Golden Valley, and the Colorado City area. Kingman is the county seat. All property document recording for these areas goes through the recorder's office. Each city handles its own permits and zoning.

Note: Property records for all cities are filed at the county recorder, not at city hall.

Nearby Arizona Counties

Mohave County borders several other Arizona counties plus Nevada and California. If a property sits near a county line, make sure you search in the right county's records. The county line determines which recorder has the documents.

Counties that border Mohave include Coconino County to the east, Yavapai County to the southeast, and La Paz County to the south. Each county maintains its own recorder's office and property record system. Mohave also borders Nevada along the Colorado River.

The Laughlin and Bullhead City area sits right on the Arizona-Nevada border. If you are looking at property in this area, confirm which state the parcel is in before searching records. Arizona and Nevada have completely different recording systems.