Chandler Property Records

Chandler property records cover deeds, mortgages, liens, and other real estate documents for this fast growing city in southeast Maricopa County. The city has grown from a small farming community into a major tech hub with over 275,000 residents. All property recording for Chandler goes through the Maricopa County Recorder's Office in Phoenix. The county database holds over 50 million documents dating back to 1871. While the county handles ownership records, Chandler manages its own planning and zoning through the Development Services department. This guide shows you how to search Chandler property records through both county and city systems.

Chandler Quick Facts

Where Chandler Property Documents Are Filed

Property documents for Chandler addresses file at the Maricopa County Recorder's Office in downtown Phoenix. The city of Chandler does not record deeds. This follows Arizona's county based system where all land records go through the county regardless of which city the property sits in. The Maricopa County Recorder handles recording for Chandler, Phoenix, Mesa, and every other city within county lines.

The Maricopa County Recorder's Office is at 301 W Jefferson St, Suite 200 in Phoenix. Office hours run Monday through Friday from 8:00 AM to 5:00 PM. No appointment needed. Walk in and record your documents on the spot. The staff processes papers while you wait during normal hours. You can also call them at 602-506-3535 for questions about recording requirements or fees.

Recording a standard document costs $30. Government agencies pay $15. These fees come from A.R.S. 11-475 which sets uniform recording fees across Arizona. Copies run $0.50 to $1.00 per page. Certified copies add $1.50 to $3.00 for the certification. The office takes cash, checks, and credit cards.

Mail recording works if you cannot visit in person. Send documents to the recorder's office with the fee included. Put a return address on the envelope or document. Processing takes 2 to 4 weeks for mail submissions. Your recorded original comes back by mail once filed.

Search Chandler Property Records Online

The Maricopa County document search gives free online access to recorded property documents. The database covers all Chandler addresses along with every other property in the county. Over 50 million documents and 185 million page images are searchable. Records date back to 1871 when Arizona was still a territory.

Search by owner name, property address, parcel number, or legal description. Results show the document type, recording date, and parties involved. You can view document images online at no cost. This lets you read deeds, mortgages, and liens from home. If you need certified copies for court or a government agency, order them through the recorder's office.

The county also offers an e-recording program for title companies and lenders. Over 90 percent of Chandler property documents now file electronically through approved vendors. Digital recordings show up in the public index immediately. If you just closed on a Chandler home, the deed may already be searchable even before the paper copy arrives in the mail.

Note: The online database shows recorded documents only. New filings take a day or two to appear after processing.

Chandler Planning and Zoning

While the county handles deed recording, Chandler manages its own planning and zoning. The Chandler Planning and Zoning Division oversees land use, development review, and zoning changes within city limits. They control what can be built on each parcel and what uses are allowed. Contact them at 480-782-3050 for planning questions.

The planning division reviews development proposals, processes rezoning requests, and enforces zoning codes. Their records show what permits have been pulled for each property and whether inspections passed. Before buying land in Chandler for development, check the zoning to confirm your intended use is allowed. Zoning rules cover building heights, setbacks, lot coverage, and permitted activities. If your plans do not match the current zoning, you may need a variance or rezoning approval.

Chandler has seen rapid growth in recent decades. Many new subdivisions have CC&Rs that add private restrictions on top of city zoning. These covenants, conditions, and restrictions are recorded documents that run with the land. HOA rules might limit paint colors, landscaping choices, or rental use. Check both public zoning and private CC&Rs before buying.

Chandler Property Maps and GIS

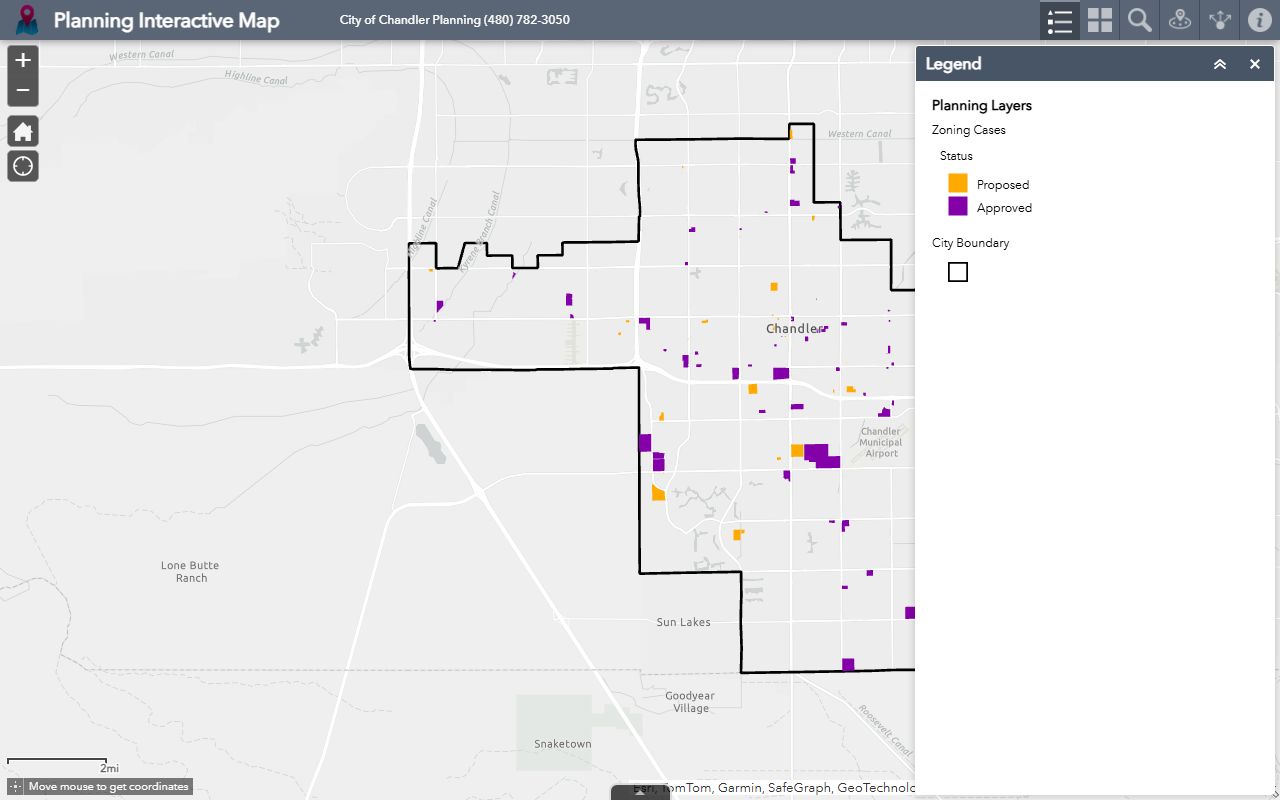

Chandler provides an interactive planning map for viewing parcel boundaries and zoning information. This GIS tool shows zoning districts, overlay areas, and general plan designations for every address in the city.

Click any parcel to see its zoning classification and basic property details. The map helps when you need to understand what zone a property falls under or what uses surrounding land allows. Aerial imagery shows building footprints and lot layouts. You can zoom in to see specific parcels or zoom out for neighborhood context.

The county assessor also runs a parcel viewer with assessed values and tax information. This separate tool focuses on ownership and valuation rather than zoning. Use both systems together for complete Chandler property research. The city map tells you what you can build. The county map tells you who owns it and what it is worth.

GIS data updates regularly but may lag behind actual recordings by a few days. For the most current ownership information, always check the recorder's database directly.

Requirements for Chandler Property Documents

Documents recorded for Chandler properties must meet Arizona's state requirements. A.R.S. 11-480 sets the standards. Every document needs a caption at the top stating what it is. A deed caption says "Warranty Deed" or "Quitclaim Deed" depending on the type. Papers must be original and clear enough to copy. Margins of at least half an inch are required on all sides. The top of page one needs a two inch margin for the recorder's stamp.

Most Chandler deeds require an Affidavit of Property Value. Under A.R.S. 11-1133, sellers and buyers must state the sale price on a form attached to the deed. The county uses this info to update tax records. If your transfer qualifies for an exemption under A.R.S. 11-1134, you list the exemption code instead. Common exemptions include gifts between family members, trust transfers, and certain corporate transactions. Without the affidavit or exemption code, the recorder rejects the deed.

All deeds must be signed and notarized. A.R.S. 33-401 requires the grantor to sign and acknowledge the document before an authorized officer. The notary verifies identity and witnesses the signature. Incomplete notarization means rejection at the counter.

Types of Chandler Property Documents

Several document types appear in Chandler property records. Each serves a different purpose in establishing ownership and encumbrances.

Warranty deeds are the most common for home sales. The seller guarantees clear title and promises to defend against any claims. If title problems surface later, the seller is responsible. Buyers in Chandler typically receive warranty deeds at closing because they offer the strongest protection. The deed shows buyer and seller names, the legal description, recording date, and often the sale price.

Quitclaim deeds transfer whatever interest the grantor has without guarantees. They are common between spouses, family members, or to fix title defects. A quitclaim might convey full ownership or nothing at all depending on what the grantor actually owns. These deeds work well for low risk transfers where parties know each other.

Deeds of trust secure mortgage loans. When you borrow to buy a Chandler property, the lender records a deed of trust against it. This gives the lender rights to foreclose if payments stop. Arizona uses deeds of trust rather than traditional mortgages. Once paid off, the lender records a reconveyance to clear the lien. Outstanding deeds of trust show current mortgage debt on a property.

Other documents include:

- Mechanics liens from contractors and suppliers

- HOA liens for unpaid assessments

- Tax liens for delinquent property taxes

- Easements granting access or utility rights

- Notices of default starting foreclosure

Each recorded document gets a number and date stamp. This creates the public record that title searchers review before any sale.

Chandler Property Tax Information

The Maricopa County Assessor values all Chandler real estate for tax purposes. Each year the assessor determines property values that set your tax bill. Arizona uses two values. Full cash value reflects market price. Limited property value calculates actual taxes and has caps on annual increases. Property owners get notices each year showing values and can appeal within 60 days if they disagree.

The Maricopa County Treasurer collects property taxes. Chandler owners pay in two installments. First half due October 1, late after November 1. Second half due March 1, late after May 1. Late payments add interest and penalties to your bill. The treasurer's website lets you pay online and view payment history.

Unpaid taxes create liens against the property. After several years of non payment, the county sells tax liens at auction. Investors buy liens and earn interest when owners pay up. If taxes stay unpaid, the lienholder can eventually foreclose. Always check tax status before buying Chandler property to avoid inheriting someone else's tax debt. Tax liens appear in property record searches along with deeds and mortgages.

Why Recording Matters in Chandler

Recording your deed protects your ownership rights. Under A.R.S. 33-411, an unrecorded deed does not give notice to later purchasers. If you buy Chandler property but fail to record, someone else might claim they did not know about your purchase. This could create title disputes. Recording establishes your place in the chain of ownership and puts the world on notice.

A.R.S. 33-416 states that a properly recorded document provides notice to all persons of its existence. Once filed, everyone is legally considered to know about the document. This is called constructive notice. You cannot claim ignorance of a recorded lien or deed in Arizona. Title searches rely on this principle. A buyer checks the records and trusts that any claims against land will appear there.

Record promptly after closing. The sooner your deed goes on file, the sooner your ownership is protected against competing claims. Title companies typically handle recording as part of the closing process, but verify your deed was actually recorded. The recording number should appear on your final documents.

Nearby Arizona Cities

Chandler borders several other cities in the southeast valley. All file property documents through the same Maricopa County Recorder. Each city has its own planning and zoning rules. Properties near city lines may have addresses in one city while physically sitting closer to another.

Cities around Chandler include Gilbert to the east, Mesa to the north, Tempe to the northwest, and Phoenix to the west. The City of Maricopa lies to the south in Pinal County. If you are researching property near the Pinal County line, verify which county the address falls in. The county determines where you record and search property documents.

Chandler also borders Queen Creek to the southeast. Queen Creek straddles the Maricopa and Pinal county line. Some Queen Creek addresses file with Maricopa County and others with Pinal County. Always check the county before searching records.