Mesa Property Records Database

Mesa property records provide access to deeds, mortgages, liens, and other land documents for Arizona's third largest city. Located in the east valley of the Phoenix metro area, Mesa sits within Maricopa County. The Maricopa County Recorder's Office handles all property recording for Mesa addresses. The city does not record deeds or maintain ownership records. However, Mesa offers robust development services including a public permits database that complements the county's recorded documents. This guide explains how to search Mesa property records through both the county recorder and city resources.

Mesa Quick Facts

Where Mesa Property Records Are Filed

Mesa property records go through the Maricopa County Recorder's Office in Phoenix. The recorder's main location is at 301 W Jefferson St, Suite 200 in downtown Phoenix. Office hours are Monday through Friday from 8:00 AM to 5:00 PM. You can call them at (602) 506-3535. No appointment is needed for in-person recording.

Recording a deed or other property document in Mesa costs $30 for most standard documents. This flat fee was set by state law in 2019 and applies across Arizona. Government recordings cost $15. Copies from the recorder's office run between $0.50 and $1.00 per page. Certified copies add $1.50 to $3.00 for the certification stamp.

When you record in person, documents are returned immediately after processing. Mail recordings take 2 to 4 weeks. The recorder mails your original back to the return address on the envelope or the upper left corner of the document. E-recording through approved vendors is also available and used by most title companies and lenders for faster processing.

Before recording a deed that transfers property for value, you need an Affidavit of Property Value or must list an exemption code on the document. The recorder will reject deeds without this state-required form under A.R.S. 11-1133.

Searching Mesa Property Records Online

The Maricopa County document search portal provides free online access to recorded property documents including those for Mesa addresses. The database contains over 50 million documents with 185 million images dating back to 1871. You can search by owner name, address, legal description, or subdivision name.

Search results show basic document information like recording date, document type, and parties involved. You can view document images directly through the website. This lets you review deeds, mortgages, and liens from your computer without visiting the recorder's office. For certified copies or documents not available online, you can request them through the office or by mail.

The county assessor also provides property information for Mesa. The Maricopa County Assessor website shows ownership details, assessed values, and property characteristics. Their parcel viewer map lets you search by address and view parcel boundaries, tax information, and aerial photos. Together, the recorder and assessor systems give you a full picture of Mesa property records.

Mesa Development Services

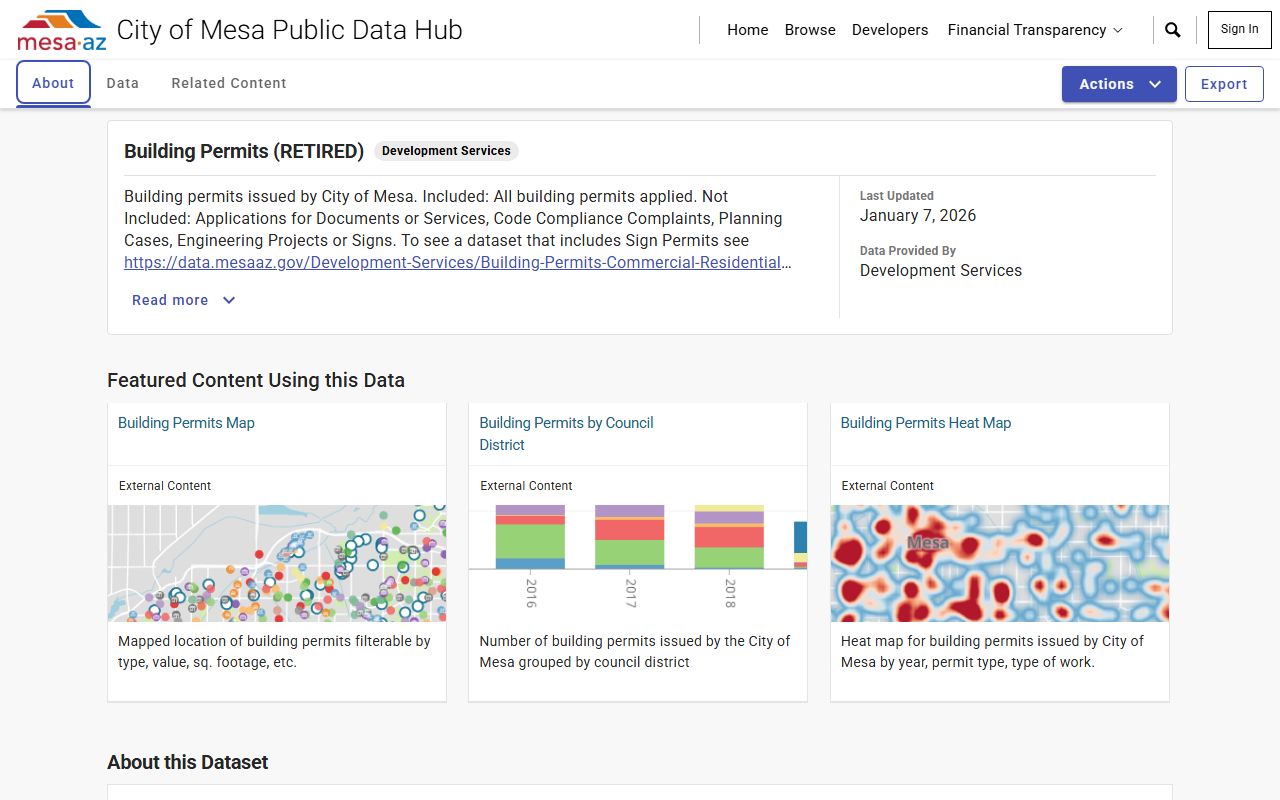

While property recording stays at the county level, Mesa's Development Services Department manages building permits, zoning, and land use within city limits. They handle permit applications, plan reviews, inspections, and code enforcement for Mesa properties.

The city maintains a public Building Permits Database where you can search permit records for any Mesa address.

This database shows permit applications, approval dates, work descriptions, and permit status. Buyers often check permit history to see what work has been done on a property and whether all permits were properly closed. Unpermitted construction can cause problems during sales or when making insurance claims. The database is free to search and includes permits going back several years.

Mesa uses a zoning code that divides the city into residential, commercial, industrial, and mixed use districts. Before starting construction or buying property for a specific use, check the zoning to confirm it allows your plans. The development services office can answer zoning questions and explain what approvals you might need.

Types of Mesa Property Documents

Several document types make up the property records for Mesa real estate. Each serves a different function in the chain of title and property rights.

Warranty deeds transfer ownership from seller to buyer with guarantees about the title. When you buy a house in Mesa, you typically receive a warranty deed at closing. The seller promises they own the property and have the right to sell it. Any title problems discovered later become the seller's responsibility to fix. Most home sales in Mesa use warranty deeds because they give buyers the strongest protection.

Special warranty deeds provide limited guarantees. The seller only promises there are no title problems from their own actions. Issues from before their ownership are not covered. These deeds are more common in commercial transactions or foreclosure sales where the seller has limited knowledge of the full title history.

Deeds of trust secure mortgage loans on Mesa properties. The document names a trustee who can foreclose if the borrower stops paying. Once the loan is paid off, the lender records a deed of reconveyance to release the lien. When searching property records, outstanding deeds of trust show existing mortgage debt on a property.

Liens come from various sources including contractors who did work on the property, homeowner associations, and tax authorities. A mechanics lien can be filed by contractors or suppliers who were not paid. HOA liens arise from unpaid assessments. Tax liens attach for unpaid property taxes. All liens must be cleared before selling or refinancing.

Mesa Property Taxes

Property taxes for Mesa are collected by the Maricopa County Treasurer. Tax bills come twice a year. The first half is due October 1 and becomes delinquent after November 1. The second half is due March 1 and becomes delinquent after May 1. Late payments incur interest and penalties.

The Maricopa County Assessor sets property values each year. Arizona uses two value types for taxation. Full cash value reflects what the property would sell for on the open market. Limited property value is used to actually calculate your tax bill and has caps on how much it can increase annually. You receive a notice of value each year and can appeal if you think the assessment is wrong.

Before buying property in Mesa, check that taxes are current. Delinquent taxes can become liens that transfer with the property. The county treasurer's website shows payment history and any amounts owed. Title companies verify tax status as part of the closing process, but checking yourself adds another layer of due diligence.

Note: Property tax rates in Mesa include levies for city services, schools, and special districts in addition to the county tax.

Recording Requirements for Mesa

Arizona law sets requirements for documents recorded against Mesa properties. Under A.R.S. 11-480, every instrument must have a caption stating its nature, such as warranty deed or deed of trust. Documents need legible text and proper margins. The first page must have a two-inch top margin for the recorder's stamp.

All deeds must be signed by the grantor and acknowledged before a notary public as required by A.R.S. 33-401. The notary verifies the signer's identity and witnesses their signature. Without proper acknowledgment, the recorder will reject the document.

Recording provides legal notice to the world under A.R.S. 33-416. Once a document is properly recorded, everyone is considered to know about it. This is why recording your deed quickly after a purchase matters. An unrecorded deed under A.R.S. 33-411 does not give notice to later purchasers who might buy the same property from a dishonest seller.

Nearby Arizona Cities

Mesa borders several other east valley cities that also file property records through Maricopa County. If you are searching for properties near city boundaries, verify which city the address is in for permit and zoning purposes. Property recording goes through the same county office regardless of which city the property sits in.

Cities surrounding Mesa include Gilbert to the south, Chandler to the southwest, Tempe to the west, and Scottsdale to the northwest. Phoenix lies to the west across Tempe. Each city manages its own planning and permit processes while sharing the Maricopa County Recorder for property documents.

The eastern edge of Mesa approaches Pinal County. Some addresses that seem to be in Mesa might actually fall in Pinal County territory. Always verify the county before searching property records. The Maricopa County parcel viewer can help confirm whether an address is within county boundaries.