Search Pinal County Property Records

Pinal County property records include deeds, mortgages, liens, and other land documents stored by the County Recorder in Florence. This fast-growing county between Phoenix and Tucson has seen rapid development in recent years, which means a high volume of new property filings. The recorder's office processes and maintains these records so the public can access them for personal or business purposes. You can search property records online through their database or visit the office in person. Whether you need to verify ownership, check for liens, or research a property's history, Pinal County provides the tools to get the information you need.

Pinal County Quick Facts

Pinal County Recorder's Office

The Pinal County Recorder's Office processes and maintains property records for public access. Dana Lewis serves as the current recorder. The office handles all document recording for real estate transactions throughout the county.

The recorder's office is located at 31 N Pinal Street, Building E in Florence. Florence is the county seat, located about 60 miles southeast of Phoenix. The historic town center hosts most county government offices. You can reach the recorder by phone at 520-866-6830. There is also a toll-free number: 888-431-1311. This makes it easy to call even if you are outside the local area.

The recorder's website shows office information and links to recording services for Pinal County.

Recording can happen in person, by mail, or electronically. Walk-in recording is available during business hours. Mail your documents to the Florence address with the proper fees. E-recording through approved vendors is the fastest option and is used by most title companies. Over 90 percent of documents in Arizona now come through e-recording systems.

The recorder's office does not provide legal advice. Staff can tell you if a document meets recording requirements, but they cannot help you prepare documents or explain what forms you need. For legal questions, consult an attorney or title company.

Pinal County Document Search

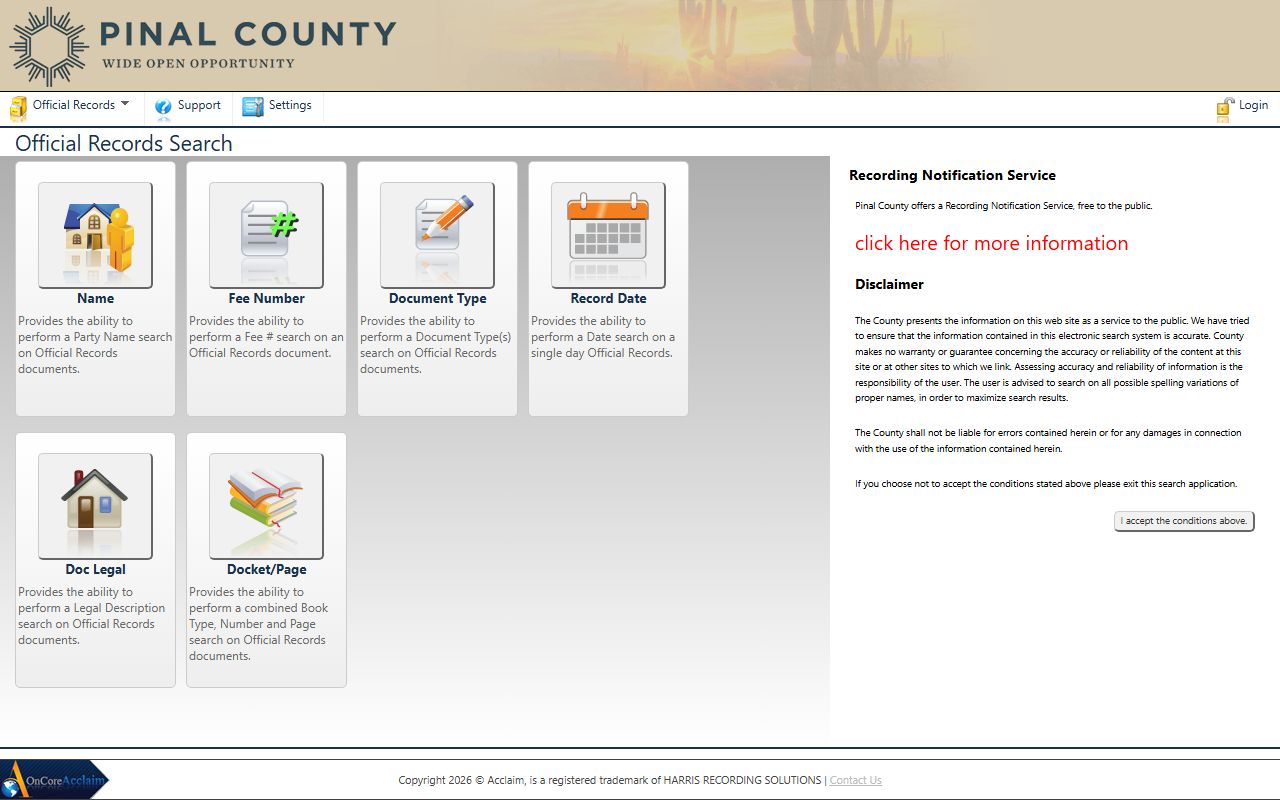

Search recorded documents through the Pinal County AcclaimWeb database. This online system lets you look up property records by name, document type, recording date, or book and page number. The database includes deeds, mortgages, liens, releases, and other recorded papers.

The AcclaimWeb portal is the main way to search Pinal County property records online. Results show recording information and document details.

Basic searches are free. You can see what documents exist and when they were recorded. If you need actual copies, the fee is $1 per page. This is slightly higher than some other Arizona counties, but still reasonable for most needs. Certified copies are available for legal purposes at an additional charge.

The online database is updated regularly as new documents get recorded. This makes it useful for title searches and verifying current ownership in Pinal County. Real estate professionals use this system daily to check titles and find liens.

Note: Some very old documents may not be in the online system and may require an in-person search.

Recording Requirements

Arizona has specific requirements for documents to be accepted for recording. Under A.R.S. 11-480, documents must meet format standards or they will be rejected. Knowing these rules before you submit can save time and hassle.

Every document needs a caption that briefly states what it is. Examples include warranty deed, quit claim deed, release of mortgage, or deed of trust. The first page must have at least a two-inch top margin reserved for recording information. The recorder stamps this area with the recording date, book, page, and document number. All sides need at least a half-inch margin.

Documents must be originals and clearly readable. The recorder will make certified copies from what you submit, so legibility matters. Faded, smudged, or poorly scanned documents may be rejected. If your document has exhibits or attachments, make sure those are also clear.

For deeds transferring property, you must include either an Affidavit of Property Value or an exemption code. This requirement under A.R.S. 11-1133 helps the state track real estate sales values. Common exemptions include transfers between family members and certain trust transactions. Without this form, your deed will not be recorded.

Recording Fees in Pinal County

Pinal County charges $30 to record most documents. This flat fee applies to deeds, mortgages, releases, and other standard papers. The fee is per document, not per page. A ten-page deed costs the same as a one-page release.

Plats and surveys have different pricing:

- First page: $24

- Each additional page: $20

- Government recordings: Half the standard rate

Copies are $1 per page. Add $3 for certification if you need a certified copy. These fees are set by state law and are similar across Arizona counties.

Pinal County Property Assessor

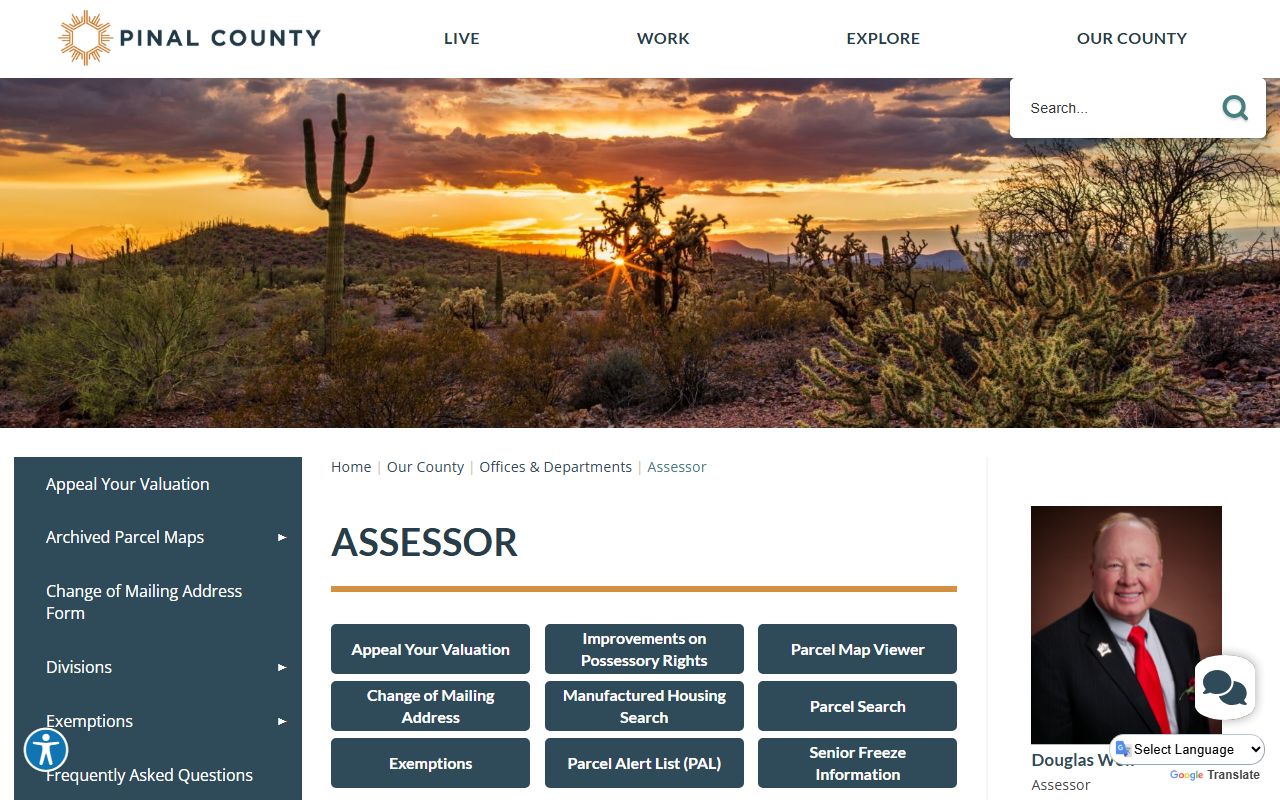

The Pinal County Assessor values property for tax purposes. Phone 520-866-6361 with assessment questions. The assessor determines what each property is worth and calculates values used for tax bills.

The assessor's website provides information about property values and the assessment process in Pinal County.

You can search property information through the Pinal County parcel search tool. Enter an address or parcel number to see ownership info, property details, and assessed values. This tool shows lot size, building square footage, year built, and other characteristics.

The parcel search shows detailed property information for any parcel in Pinal County.

If you think your property value is wrong, you can appeal. Arizona law under A.R.S. 42-16201 gives property owners the right to challenge assessed values. You have 60 days from your notice date to file an appeal for real property.

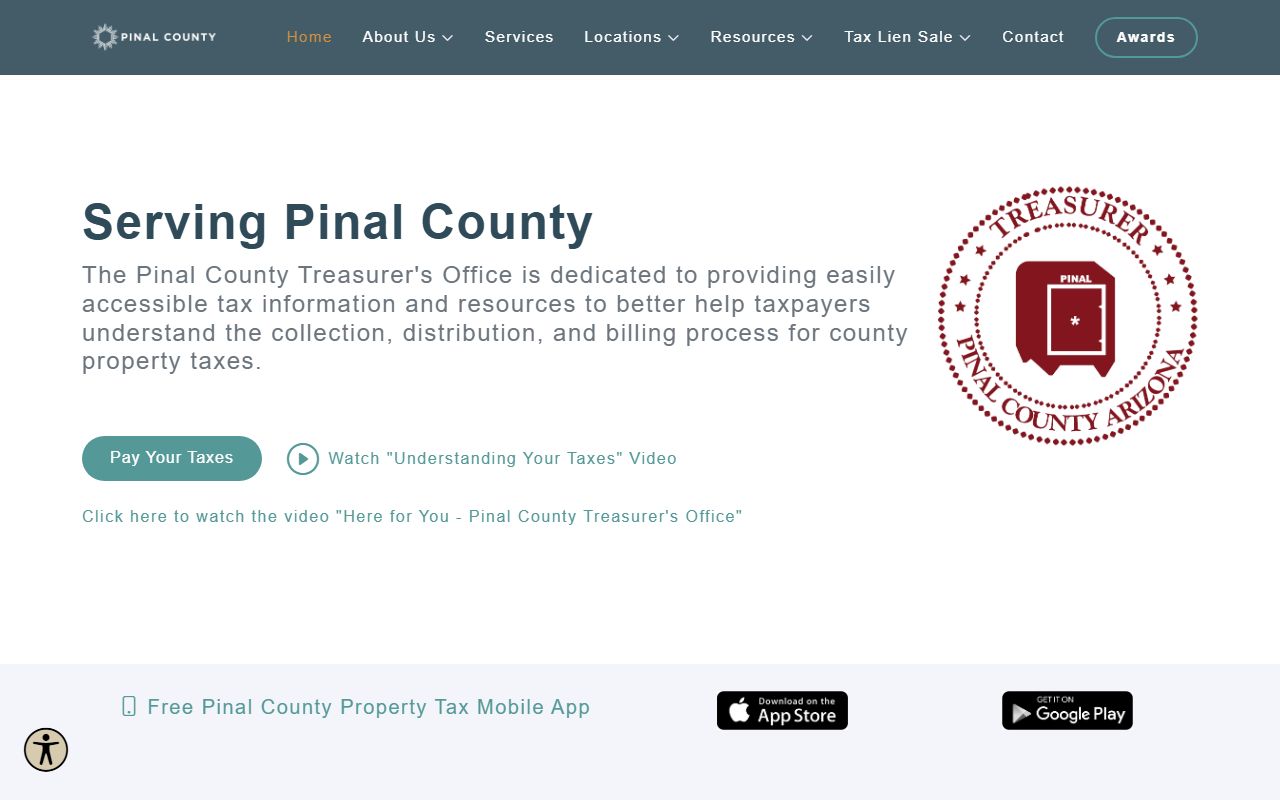

Property Taxes in Pinal County

The Pinal County Treasurer collects property taxes. Call 520-509-3555 with tax questions. The treasurer sends tax bills and processes payments for all real property in the county.

The treasurer's site shows tax payment options and account information for Pinal County properties.

Property taxes in Arizona are paid in two installments. The first half is due October 1 and becomes delinquent after November 1. The second half is due March 1 and becomes delinquent after May 1. Pay on time to avoid interest and penalties.

You can pay online, by mail, or in person. The treasurer's website has links to the payment portal. Credit cards and electronic checks are accepted for online payments. There may be a small fee for credit card transactions.

Tax records help when buying property. Check if taxes are current before you close. Delinquent taxes create liens that stay with the property regardless of who owns it.

Pinal County GIS Maps

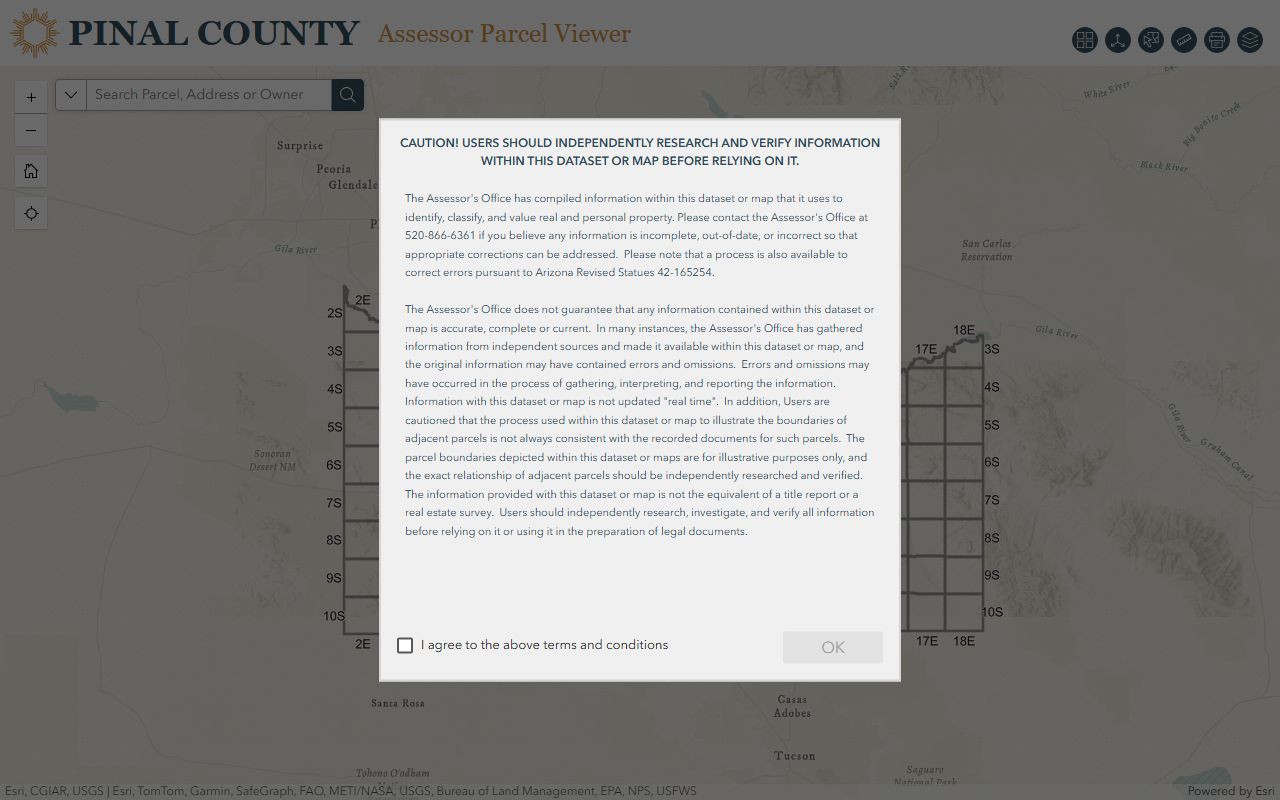

The county provides GIS mapping through the Pinal County Parcel Viewer. This interactive map shows property boundaries, addresses, and land features across the county. Search by address or navigate the map to find parcels.

The parcel viewer displays aerial imagery and parcel boundaries for Pinal County properties.

GIS maps are useful for understanding where a property is located and what surrounds it. You can see neighboring parcels, roads, and land features. However, map boundaries are for reference only. Legal property lines come from recorded surveys and legal descriptions in deeds.

Note: Always verify boundary information with recorded documents for legal purposes.

Cities in Pinal County

Pinal County contains several growing cities. Property recording for all these cities goes through the Pinal County Recorder in Florence. Each city has its own planning and zoning offices for permits, but property documents are filed at the county level.

Major cities in Pinal County include:

- Casa Grande - largest city in Pinal County

- Maricopa - fast-growing community near Phoenix

- Queen Creek - spans Pinal and Maricopa counties

Smaller towns include Florence, Coolidge, Eloy, and Apache Junction. Florence is the county seat where the recorder's office is located. Apache Junction sits partially in Maricopa County, so check which county a property falls in before searching records.

Nearby Arizona Counties

Pinal County borders several other Arizona counties. Properties near county lines may be in a different county than you expect. Always verify which county a property is in before searching records.

Counties that border Pinal include Maricopa County to the west, Pima County to the south, Gila County to the northeast, and Graham County to the east. Cochise County lies to the southeast. Each county maintains separate property records and offices.