Scottsdale Property Records

Scottsdale property records provide the official history of real estate ownership in this resort city northeast of Phoenix. These records include deeds, mortgages, liens, and easements that affect land and buildings. The Maricopa County Recorder's Office maintains these documents, not Scottsdale city hall. You can search the county's database of over 50 million records online. The system holds documents from 1871 to present. Whether you need to verify ownership, find liens, or research a property's chain of title, the county portal is your starting point. Scottsdale's high property values make accurate records essential for buyers and sellers.

Scottsdale Quick Facts

Recording Property Documents in Scottsdale

Property deeds for Scottsdale are recorded at the Maricopa County Recorder's Office in Phoenix. The city of Scottsdale does not record property documents. This is standard across Arizona. Counties manage all deed recording, and cities fall within county jurisdiction.

The Maricopa County Recorder's Office is located at 301 W Jefferson St, Suite 200 in Phoenix. Office hours run Monday through Friday, 8:00 AM to 5:00 PM. You can walk in and record documents on the spot. No appointment needed. The staff will stamp your document with the recording date and instrument number while you wait.

Many Scottsdale real estate transactions use e-recording through approved vendors like Simplifile. Title companies and lenders prefer this method. It's faster and the documents show up in the public index immediately. Over 90 percent of Maricopa County recordings now happen electronically. If you're closing on a Scottsdale home, your title company likely handles recording for you.

Search Scottsdale Property Records Online

The Maricopa County document search lets you look up Scottsdale property records from any computer. Search by owner name, address, parcel number, or legal description. Results show the document type, recording date, and parties involved.

Basic searches are free. Viewing document images and getting certified copies cost extra. The database includes deeds, mortgages, liens, releases, easements, and other recorded instruments. Records date back to 1871, though older documents may require a visit to the office.

For property values and tax information, use the county assessor's parcel viewer. This separate system shows assessed values, lot sizes, and building details. Combining both databases gives you a complete picture of any Scottsdale property.

Note: The recorder's database shows what's recorded, not what's necessarily still valid. A mortgage shows up until the release is recorded.

Scottsdale Planning and Development Records

While the county handles deed recording, Scottsdale manages its own planning records. The Scottsdale Planning and Development department oversees zoning, permits, and land use approvals. They keep records of building permits, zoning variances, and development agreements.

The planning department maintains information about what can be built on each parcel in Scottsdale. Zoning determines the allowed uses, building heights, and setback requirements. If you're buying property in Scottsdale and plan to develop or modify it, check the zoning records first. The city also keeps records of approved site plans and conditional use permits.

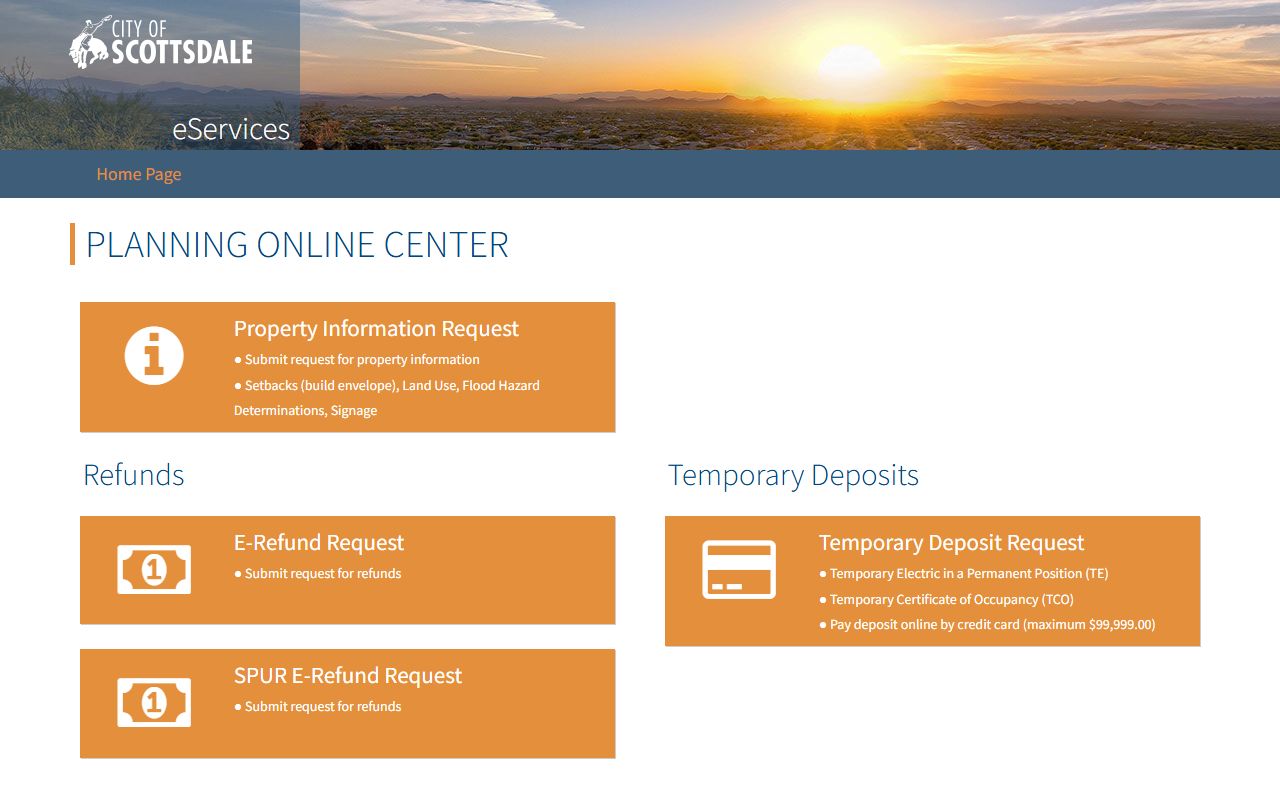

Scottsdale's eServices portal gives online access to permit information and development resources. You can look up active permits, check inspection results, and find application forms.

This portal makes it easy to research the development history of any Scottsdale address. The system shows what permits were pulled and when inspections passed.

Requirements for Scottsdale Property Documents

Documents recorded for Scottsdale properties must meet certain requirements under Arizona law. A.R.S. 11-480 sets the standards. Each document needs a caption stating what it is, like "Warranty Deed" or "Deed of Trust." Documents must be legible originals with margins of at least one-half inch on all sides. The top of the first page needs a two-inch margin for the recorder's stamp.

Most deeds in Scottsdale require an Affidavit of Property Value or an exemption code. This requirement comes from A.R.S. 11-1133. The affidavit shows the sale price for tax assessment purposes. Common exemptions include transfers between family members and certain trust transactions. Without the affidavit or exemption, the recorder will reject your deed.

All deeds must be signed by the grantor and properly notarized. Under A.R.S. 33-401, conveyances of real property must be acknowledged before an authorized officer. The recorder won't accept documents without proper notarization.

Scottsdale Property Data Resources

Scottsdale provides additional property information through its Open Data Portal. This resource includes GIS data, parcel boundaries, and development information. The portal is free to use and offers downloadable datasets.

The open data portal supplements the official property records at the county. While the county shows ownership and liens, Scottsdale's data shows zoning, permits, and land use details. Real estate professionals, researchers, and residents use both sources when analyzing Scottsdale properties. The city updates the data regularly, though it may lag a few days behind real-time recordings at the county.

GIS maps show property boundaries, aerial photos, and neighborhood context. This visual information helps when the legal description in a deed is hard to understand. You can see exactly where a parcel sits and what surrounds it.

Fees for Recording Scottsdale Property Documents

Recording fees for Scottsdale properties follow Arizona's statewide schedule. The fee is $30 per document for most instruments. This covers deeds, mortgages, releases, and similar recordings.

Additional fees apply for copies and certifications:

- Document recording: $30.00 flat fee

- Copies: $0.50 to $1.00 per page

- Certification: $1.50 to $3.00 each

- Government recordings: $15.00

The recorder's office accepts cash, checks, and credit cards. For mail-in recordings, include a check for the exact fee. Include a self-addressed envelope if you want the recorded original mailed back. Processing mail recordings takes 2 to 4 weeks.

Title History for Scottsdale Properties

Scottsdale's property values make thorough title searches essential. A title search traces ownership back through the recorded deeds to verify the seller actually owns the property. It also reveals any liens, easements, or restrictions affecting the land. Title companies perform these searches before every closing.

The county's online database makes basic searches easy. Enter an address and see what documents are recorded. But a full title search looks deeper. It checks for judgments against owners, tax liens, HOA assessments, and anything else that could cloud the title. Professional searches also verify the legal description matches the physical property.

Scottsdale has many subdivisions with CC&Rs that restrict property use. These covenants, conditions, and restrictions are recorded documents that run with the land. When you buy in a Scottsdale subdivision, you agree to follow the CC&Rs. A title search reveals these restrictions so you know what you're getting into. Some CC&Rs limit rental use, building modifications, or even paint colors.

Scottsdale Property Tax Information

The Maricopa County Assessor values Scottsdale properties for taxation. The assessed value determines your annual tax bill. You can look up any property's value through the assessor's website or parcel viewer.

Property taxes are paid to the Maricopa County Treasurer in two installments. The first half is due October 1. It becomes delinquent November 1 if not paid. The second half is due March 1 and delinquent after May 1. Late payments incur interest and penalties.

If taxes go unpaid for three years, the county can sell a tax lien on the property. Investors buy these liens and earn interest when the owner eventually pays. If the owner never pays, the investor can eventually take the property through foreclosure. Tax lien records show up in the county database along with deeds and mortgages.

Note: Always check tax status before buying Scottsdale real estate to avoid inheriting someone else's tax problems.

Nearby Arizona Cities

Scottsdale borders several other large cities in the Phoenix metro area. All fall within Maricopa County and use the same recorder's office for property documents.

Neighboring cities include Phoenix to the west and south, Tempe to the southwest, and Mesa to the south. Chandler and Gilbert are further southeast. Each city handles its own planning and zoning, but all deeds record at the county. Properties near city borders may have addresses in one city but sit physically closer to another.