Access Gilbert Property Records

Gilbert property records cover deeds, mortgages, liens, and other land documents for one of Arizona's fastest-growing communities. Located in the southeast valley of metropolitan Phoenix, Gilbert sits entirely within Maricopa County. The Maricopa County Recorder's Office handles all property recording for Gilbert addresses. The town does not record deeds or maintain ownership records itself. However, Gilbert offers an excellent permit portal and development services that complement the county's recorded documents. This guide explains how to access Gilbert property records through county and town resources.

Gilbert Quick Facts

Where Gilbert Property Records Are Filed

All property documents for Gilbert addresses go through the Maricopa County Recorder's Office located in Phoenix. The main office address is 301 W Jefferson St, Suite 200, Phoenix, AZ 85003. You can call them at (602) 506-3535. They are open Monday through Friday from 8:00 AM to 5:00 PM. No appointment is required for walk-in recording.

The standard recording fee is $30 per document under Arizona's statewide fee schedule. This applies to deeds, deeds of trust, releases, and most other property documents. Government agency recordings cost $15. Copies range from $0.50 to $1.00 per page depending on the type. Certified copies add $1.50 to $3.00 for the certification stamp.

You can record documents in person for immediate processing, by mail which takes 2 to 4 weeks, or through e-recording vendors used by title companies and lenders. The recorder's office handles over 50 million documents dating back to 1871 for all of Maricopa County including Gilbert.

Deeds transferring Gilbert property for value must include an Affidavit of Property Value or list an exemption code. The recorder rejects documents without this state-required form. Common exemptions include family transfers and certain trust transactions.

Searching Gilbert Property Documents

The Maricopa County document search portal gives you free online access to recorded property documents for Gilbert. You can search by owner name, property address, legal description, or subdivision name. The database contains over 50 million documents with 185 million images available to view.

Search results display document type, recording date, and parties involved. Document images can be viewed online without charge. This lets you review deeds, mortgages, liens, and other papers from your computer. For certified copies, you can request them through the recorder's office by mail or in person.

The Maricopa County Assessor provides additional property data including ownership names, assessed values, and property characteristics. Their parcel viewer map lets you click any parcel to see tax information, ownership details, and property boundaries. Using both the recorder and assessor systems gives you a complete view of Gilbert property records.

Note: Newly recorded documents may take a day or two to appear in online searches after recording.

Gilbert Development Services

While property recording stays at the county level, the Town of Gilbert Development Services Department handles building permits, planning, and zoning within town limits. Their office phone is (480) 503-6700 and you can email them at onestopshop@gilbertaz.gov.

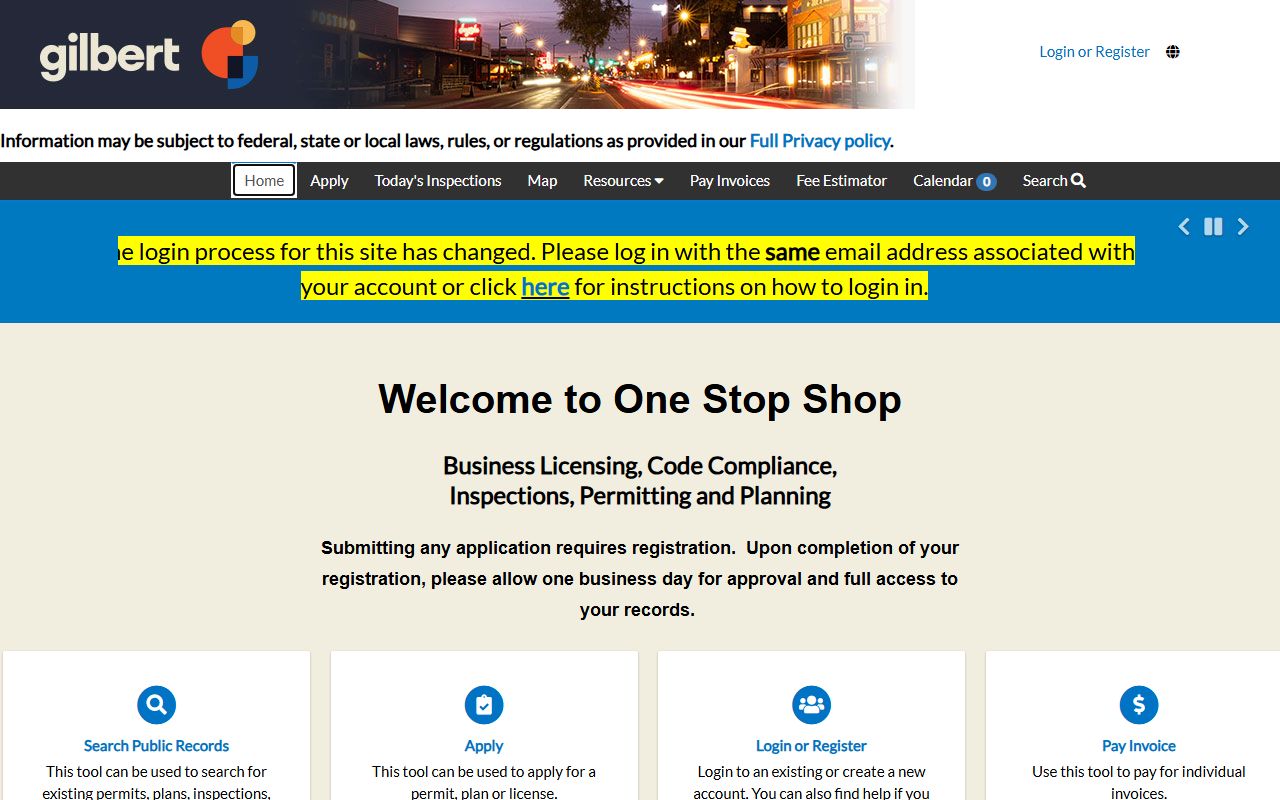

Gilbert calls their permit system the One Stop Shop because it combines multiple services in one place. The Gilbert Permit Portal provides online access to permit applications, status tracking, and inspection scheduling.

Through this portal you can apply for building permits, submit plans for review, schedule inspections, and check the status of pending applications. Creating an account is free. The system works for both homeowners doing small projects and contractors managing multiple jobs.

The permit portal also shows historical permit data for Gilbert properties. Buyers often check permit history to verify that past work was properly permitted and inspections were completed. Unpermitted construction can create problems during sales, refinancing, or insurance claims. Checking permit records takes just a few minutes and can save trouble later.

Gilbert Zoning and Land Use

Gilbert uses a zoning code that divides the town into residential, commercial, industrial, and other districts. Each district has rules about what can be built, how tall structures can be, lot coverage limits, and setbacks from property lines. Before buying property for a specific use or starting a construction project, verify the zoning allows your plans.

The Development Services Department answers zoning questions and can explain what permits or approvals you need. Some projects require variances if they do not fit current zoning. Others may need use permits for specific activities. Contact the department early in your planning process to understand requirements.

Gilbert has experienced rapid growth over the past two decades, transforming from a small agricultural community to one of the largest towns in Arizona. This growth means many newer subdivisions with master planned communities, HOA restrictions, and specific development guidelines. When researching Gilbert property, consider both the town zoning and any HOA covenants that may apply.

For detailed zoning maps, contact Development Services or check the town's GIS resources. The maps show zoning districts, overlay areas, and special planning zones throughout Gilbert.

Types of Gilbert Property Documents

Several document types make up the property records for Gilbert real estate at the county recorder's office.

Warranty deeds transfer ownership with full guarantees from the seller. They promise the seller owns the property free of undisclosed claims and has the right to sell. Most Gilbert home sales use warranty deeds. The deed shows transfer date, buyer and seller names, legal description, and often the purchase price.

Quit claim deeds transfer whatever interest the grantor owns without any promises about title quality. These work for family transfers, adding a spouse to title, or clearing potential claims. The grantee receives whatever the grantor had, which might be full ownership or might be nothing.

Deeds of trust secure mortgage loans. When you borrow money to buy a Gilbert home, the lender records a deed of trust against the property. This gives the lender the right to foreclose if you stop paying. Once the loan is paid off, a deed of reconveyance is recorded to release the lien.

Other common recorded documents include mechanics liens from contractors, HOA assessment liens, easements, restrictive covenants, and various legal notices. Each creates a public record that affects the property until released or resolved.

Gilbert Property Tax Records

The Maricopa County Assessor determines property values for Gilbert homes and commercial buildings each year. Eddie Cook is the current assessor. The office handles over 1.8 million parcels countywide with values exceeding $1 trillion combined.

Arizona uses two value types for property tax purposes. Full cash value reflects market value. Limited property value is used to calculate actual tax bills and has caps on annual increases. You receive a notice of value each year showing both values. If you disagree with the assessment, you can appeal within 60 days using state forms.

Property taxes are collected by the Maricopa County Treasurer. Bills come twice yearly. First half is due October 1 and becomes delinquent after November 1. Second half is due March 1 and becomes delinquent after May 1. The treasurer's website shows payment history and allows online payment.

Gilbert property tax rates include levies for town services, schools, community college, and various special districts. Rates vary depending on exactly where in Gilbert the property is located and which taxing districts it falls within.

Arizona Recording Requirements

State law governs how property documents are recorded in Gilbert and throughout Arizona. Under A.R.S. 33-411, an unrecorded instrument affecting real property does not provide notice to later purchasers. Recording your deed promptly protects your ownership rights.

Document format rules under A.R.S. 11-480 require a caption stating the document type, legible text, and proper margins. The first page needs a two-inch top margin for the recorder's stamp. All deeds must be signed by the grantor and acknowledged before a notary per A.R.S. 33-401.

Once properly recorded, documents provide constructive notice to everyone under A.R.S. 33-416. Anyone searching the records is assumed to find them. This is the foundation of Arizona's recording system. Public recording creates certainty about property ownership and existing liens.

Nearby Arizona Cities

Gilbert borders several other east valley communities that also file property records through Maricopa County. Each municipality handles its own permits and zoning while sharing the county recorder for property documents.

Cities and towns surrounding Gilbert include Chandler to the west, Mesa to the north, and Queen Creek to the southeast. Scottsdale lies to the northwest. Phoenix is to the west through Chandler and Tempe. All these communities use Maricopa County for recording.

The eastern and southern edges of Gilbert approach the boundaries of Pinal County. Some addresses that seem to be in the Gilbert area may actually fall in Pinal County jurisdiction. Properties in Pinal County file with the Pinal County Recorder. Always verify which county a property sits in before searching records.

Note: When searching properties near city or county boundaries, confirm the correct jurisdiction for permits and zoning even though county recording covers larger areas.