Lake Havasu City Property Records

Property records in Lake Havasu City document the ownership and legal status of real estate along the Colorado River corridor. These records include deeds, mortgages, liens, and easements that shape land ownership in this western Arizona resort community. The Mohave County Recorder's Office maintains all property documents for Lake Havasu City, not the city itself. Searching these records helps you confirm who owns a property, what debts attach to it, and whether the title is clear before you buy or sell. Lake Havasu City has grown fast, and the recording system keeps pace with new development and transfers.

Lake Havasu City Quick Facts

Recording Documents in Lake Havasu City

All property deeds for Lake Havasu City are recorded at the Mohave County Recorder's Office. The city does not handle deed recording. This follows Arizona's county-based system for property records. Mohave County runs satellite offices to serve the spread-out population, and Lake Havasu City has its own location at 2001 College Dr, Suite 93.

The Lake Havasu City office can be reached at (928) 453-0702. Hours run Monday through Friday during normal business hours. You can walk in to record documents or pick up copies. The staff will stamp and return your deed while you wait if you visit in person. For more complex needs, the main Mohave County office in Kingman handles all recorder functions at 700 West Beale Street. That phone number is (928) 753-0701.

Many people in Lake Havasu City use e-recording now. Title companies and lenders send documents electronically through approved vendors. The documents enter the public record faster this way. Recorder Lydia Henry oversees operations across all Mohave County locations, including the branch in Lake Havasu City.

Search Lake Havasu City Property Records Online

The Mohave County document search portal lets you look up Lake Havasu City property records from home. This EagleWeb system provides access to recorded documents across the county. Search by owner name, parcel number, or document type to find what you need.

Basic index searches are free. You can see the recording date, document type, and parties involved at no charge. Viewing the actual document images or ordering certified copies costs extra. The database covers deeds, mortgages, deed releases, liens, and other instruments recorded in Mohave County. Lake Havasu City records are mixed in with those from Kingman, Bullhead City, and other Mohave County communities.

The Lake Havasu City Planning and Zoning department handles permits and land use records separate from the county. You can reach them at (928) 453-4148 or email planninginfo@lhcaz.gov for questions about zoning and development approvals in the city.

This department keeps records of what can be built on each lot in Lake Havasu City. Zoning laws control building height, lot coverage, and allowed uses. Check here before buying if you plan to modify a property.

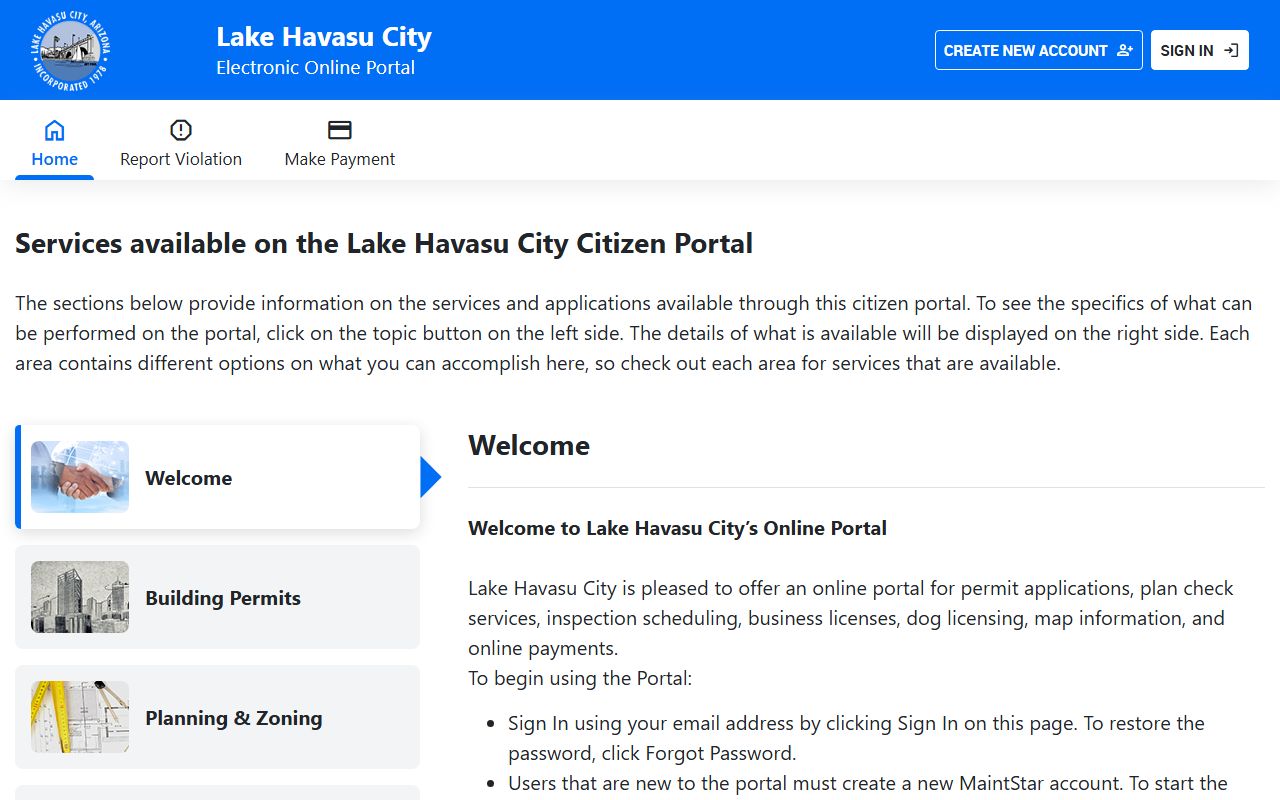

Lake Havasu City Permit Records

The city runs its own permit portal for building and development records. This system tracks permits, inspections, and code compliance. It works separately from the county's deed recording system but provides key property information.

The permit portal shows what work has been done on a property over the years. Buyers use it to verify permits were pulled for additions, pools, and other improvements. You can search by address to see a property's permit history. Unpermitted work can cause problems when selling, so this is an important resource.

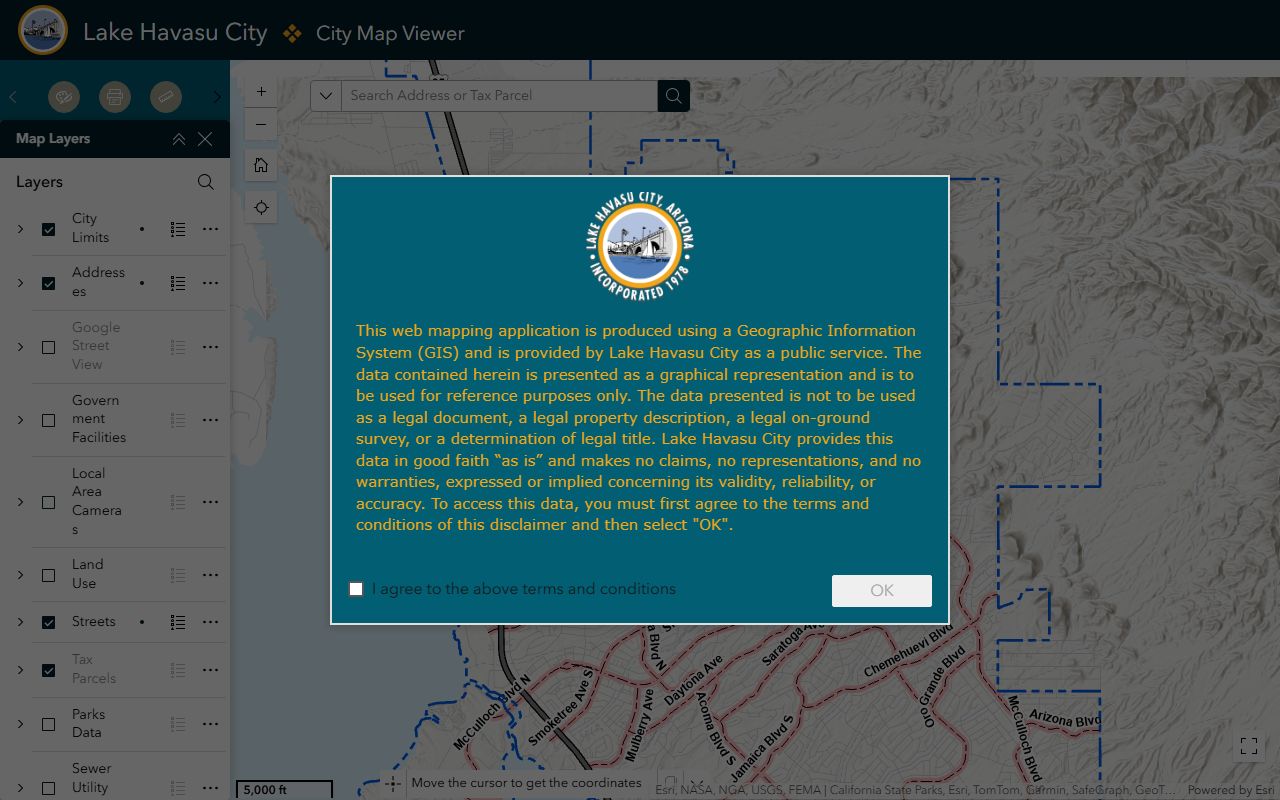

Lake Havasu City also offers a map viewer that shows parcel boundaries, zoning, and other geographic data. The map complements the text-based searches available through the permit portal and county recorder.

Use this tool to see where a property sits in relation to flood zones, utility easements, and other features that affect land use. Visual maps make it easier to understand legal descriptions that can seem abstract in document form.

Lake Havasu City Property Document Requirements

Documents recorded for Lake Havasu City properties must follow Arizona's statewide standards. Under A.R.S. 11-480, each document needs a clear caption like "Warranty Deed" or "Deed of Trust." The formatting matters too. You need margins of at least half an inch on all sides and a two-inch top margin on the first page for the recorder's stamp.

Most Lake Havasu City deeds also need an Affidavit of Property Value. This requirement comes from A.R.S. 11-1133. The affidavit reports the sale price so the county assessor can update property values for tax purposes. Some transfers are exempt, like those between spouses or into a trust. Without the affidavit or an exemption code, the recorder will reject your deed.

Recording protects your ownership rights. Under A.R.S. 33-411, unrecorded documents do not give notice to later buyers. This means someone could sell the same Lake Havasu City property twice if you fail to record your deed promptly. Recording first establishes your priority.

Fees for Lake Havasu City Property Records

Mohave County charges the standard Arizona recording fees for Lake Havasu City documents. The cost is $30 per document for most recordings. This covers deeds, mortgages, releases, and similar instruments.

Other common fees include:

- Standard document recording: $30.00 flat fee

- Plats and surveys first page: $24.00

- Additional plat pages: $20.00 each

- Copies: $1.00 per page

- Certification: $3.00 per document

The recorder's office accepts cash, checks, and credit cards. For mail-in recordings, send a check for the exact amount. Include your return address so they can mail the recorded document back. Mail recordings can take a few weeks to process and return.

Lake Havasu City Property Tax Records

The Mohave County Assessor's Office determines property values for Lake Havasu City real estate. Assessor Jeanne Kentch runs this office, which can be reached at (928) 753-0703. Property values set your annual tax bill, so these records matter to every property owner.

The assessor assigns each Lake Havasu City parcel a value based on market conditions and property characteristics. You can appeal if you think the value is too high. Appeals go through the assessor first, then to the state board if needed. Check your notice of value each year and act fast if something looks wrong. The appeal window is limited.

Property taxes go to the Mohave County Treasurer for collection. You can pay online through the county's payment portal. Taxes come due in two installments, with the first half due October 1 and the second due March 1. Missing these deadlines triggers interest and penalties that grow over time.

Note: Property tax liens on Lake Havasu City homes show up in the recorder's database along with other liens and encumbrances.

Title Searches for Lake Havasu City Real Estate

A title search examines the recorded history of a Lake Havasu City property to verify ownership and find any problems. Title companies do this before every closing. They trace the chain of title back through decades of deeds to make sure the seller can convey clear ownership. The search also reveals liens, judgments, and easements that could affect your use of the property.

Lake Havasu City has unique considerations for title work. Some properties border state trust land or have waterfront access rights that need careful review. Others sit in planned communities with recorded CC&Rs that restrict what you can do with your property. The title search uncovers these restrictions so you know what you're buying. Vacation homes and investment properties are common in Lake Havasu City, and both buyers and lenders want clean title before closing.

The Mohave County document alert service helps protect against fraud. You can sign up to get notified when documents are recorded against your property. This catches attempts to file fake deeds or forge ownership transfers early, before damage is done.

Lake Havasu City Property Maps

The Mohave County public map viewer shows parcel boundaries for Lake Havasu City and the rest of the county. Use it to find parcel numbers, see property lines, and understand how lots fit together in a neighborhood. The map integrates aerial photos and GIS layers for a complete picture.

Lake Havasu City sits at the junction of the Colorado River and Interstate 40. Its geography includes waterfront properties, golf course developments, and desert subdivisions. The mapping tools help you see exactly where a property falls within this varied landscape. You can zoom in to individual lots or pull back to see the broader area context.

Nearby Arizona Cities

Lake Havasu City sits in western Mohave County along the Colorado River border with California. It's relatively isolated from other major Arizona cities, sitting about 150 miles northwest of Phoenix and 200 miles west of Flagstaff. Bullhead City to the north is the nearest Mohave County community of similar size, though it falls below the qualifying population threshold.

For property records in the Phoenix metro area, see pages for cities like Phoenix, Mesa, Chandler, and Scottsdale. Those cities use the Maricopa County Recorder rather than Mohave County. For records in Flagstaff and northern Arizona, properties fall under Coconino County jurisdiction.