Access Graham County Property Records

Graham County property records include deeds, mortgages, liens, and other land documents maintained by the County Recorder in Safford. Located in southeastern Arizona along the Gila River valley, Graham County combines agricultural land, mountain terrain, and small communities. The recorder's office on Thatcher Boulevard handles all property document recording for the county. You can search property information online through the county's web portal or visit the recorder in person. Public access to these records helps buyers verify ownership and researchers trace property history.

Graham County Quick Facts

Graham County Recorder's Office

The Graham County Recorder's Office handles all property document recording in the county. The office sits at 921 Thatcher Boulevard, 2nd Floor in Safford, Arizona 85546. Contact them at (928) 428-3560 for recording questions or search assistance. Office hours run Monday through Thursday from 7:00 AM to 6:00 PM. The office is closed on Fridays.

The recorder's website provides information about services and recording requirements for Graham County property documents.

Recording fees in Graham County follow Arizona's statewide schedule. Standard documents like deeds and mortgages cost $30 to record. This flat fee applies regardless of how many pages the document contains for most instrument types. Plats and surveys use different pricing at $24 for the first page plus $20 for each additional page. Copies run $1 per page. Certified copies add $3 to the copy fee. The recorder accepts various payment methods but call ahead to confirm.

Graham County has a mix of property types. The Gila Valley supports irrigated farmland. The Pinaleno Mountains rise to over 10,000 feet. Small towns like Safford, Thatcher, and Pima contain residential subdivisions. Ranches spread across the desert and foothills. All these properties file documents through the same recorder's office following the same rules. Whether you own a town lot or a thousand acre ranch, the recording process works the same way.

Search Graham County Property Records

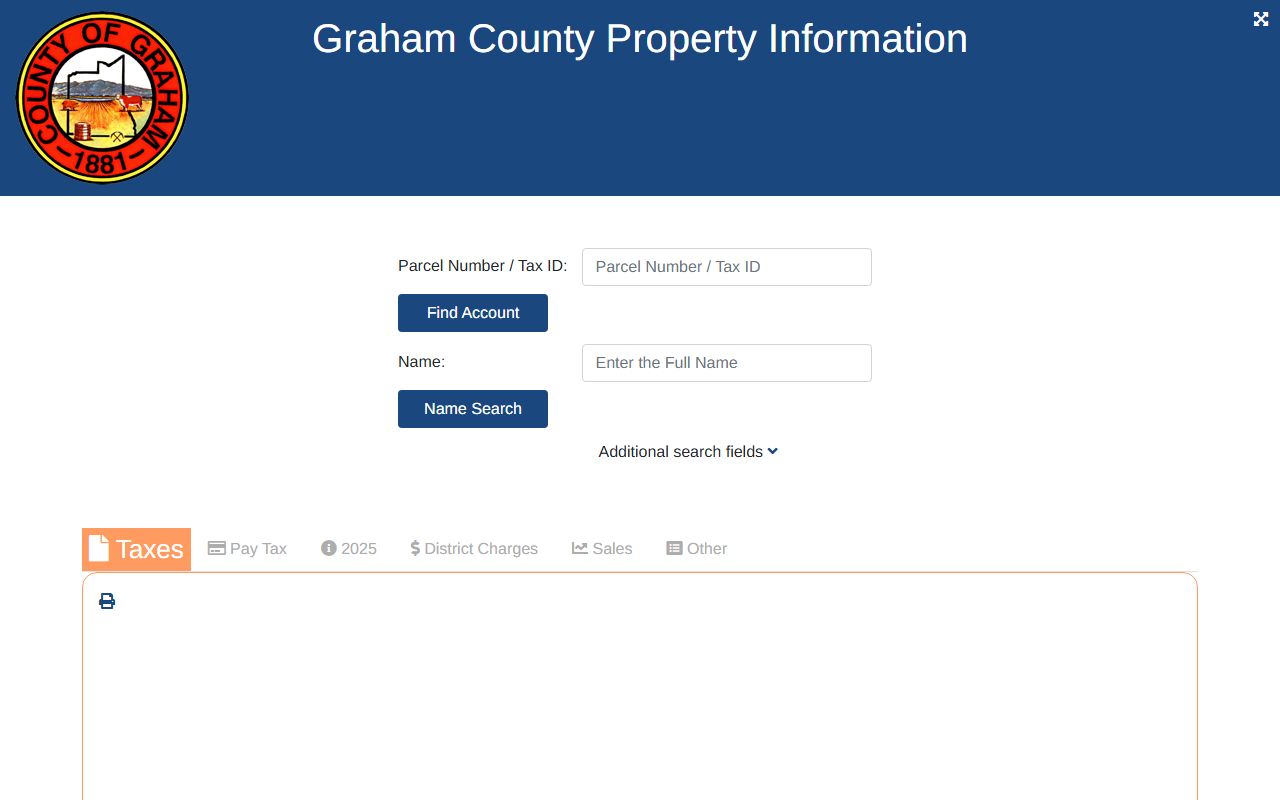

Graham County offers online property search through its web portal. This database lets you look up parcels by owner name, address, or parcel number. Search results show ownership information, assessed values, and property details. The system provides free public access to basic property data.

The property search portal provides current ownership and valuation data for parcels throughout Graham County.

When researching property in Graham County, start with the online search to identify the parcel and current owner. The search results give you the parcel number which you can use to find recorded documents. A complete title search should check all documents filed against the property including deeds, mortgages, liens, and easements. The online system shows current status but may not display all historical documents. For a thorough search going back many years, you may need to work with a title company or visit the recorder's office.

Graham County Property Assessor

The Graham County Assessor's Office values all property for tax purposes. Reach them at (928) 428-2828. The assessor sets the value of each parcel in the county every year. These valuations determine property tax amounts. Residential, commercial, agricultural, and vacant land each have different assessment methods based on their use and classification.

The assessor's office maintains property records and helps owners understand their valuations. Staff can explain how your property value was determined.

Agricultural property in Graham County may qualify for special valuation. Farms and ranches that meet income requirements get valued based on their agricultural use rather than potential development value. This can significantly reduce assessed values and tax bills for working farms. The assessor determines eligibility based on applications from property owners. Loss of agricultural status, such as when land gets developed, triggers revaluation at full market rates.

If you believe your assessment is wrong, Arizona law lets you appeal. File within 60 days of receiving your notice of value. Provide evidence like recent sales of comparable properties or appraisals showing a different value. The assessor reviews appeals and may adjust values when the evidence supports it.

Recording Requirements in Graham County

Arizona law sets standards for documents submitted for recording. A.R.S. 11-480 requires each document to have a caption briefly stating its nature. Label your document as "Warranty Deed" or "Deed of Trust" or whatever type it is. The paper must be an original with readable signatures. Notarization must meet Arizona requirements for acknowledgment.

Format rules apply to documents recorded in Graham County. Papers dated after January 1, 1991 need at least half an inch margin on all sides. Reserve a two inch margin at the top of the first page for the recording stamp. For residential deeds of trust on properties with one to four units, include "RESIDENTIAL 1-4" in the caption. Documents that do not meet these standards get rejected until you fix them.

Most deeds require an Affidavit of Property Value or exemption code. This comes from A.R.S. 11-1133. The affidavit states the sale price and both buyer and seller sign it. If your transfer qualifies for exemption, note the code on the deed. Common exemptions include transfers to family members, gifts, and trust conveyances. Without the affidavit or exemption code, the recorder will reject your deed.

Arizona Property Recording Laws

The recording system protects property rights by creating public notice. A.R.S. 11-461 charges the county recorder with keeping all records, maps, and papers deposited in the office. The recorder must separately record each instrument that law requires or authorizes for recording. This creates the permanent public record of property ownership and encumbrances.

Recording establishes priority among competing claims. Under A.R.S. 33-411, an unrecorded instrument does not give notice to subsequent purchasers. If you get a deed but fail to record it, a later buyer who pays fair value and records first could take the property from you. Recording costs only $30 but prevents this catastrophic result. Always record your deed promptly after closing.

A.R.S. 33-416 confirms that properly recorded documents serve as notice to all persons. Once recorded in Graham County, everyone is deemed to know about your property interest. This constructive notice protects recorded owners against later claims by people who say they did not know. The recording system works because all parties can search the records before buying or lending.

Nearby Arizona Counties

Graham County shares borders with several other Arizona counties. Always verify which county a property sits in before searching records. The county boundary determines which recorder's office handles the documents.

Counties bordering Graham include Greenlee County to the east, Cochise County to the south, Pinal County to the west, and Gila County to the north. Apache County lies to the northeast. Each county maintains its own separate recorder and assessor offices. Documents get filed in the county where the land is located, not where the owner lives or where the transaction closes.