Gila County Property Records Search

Gila County property records contain deeds, mortgages, liens, and land documents stored by the County Recorder in Globe. This central Arizona county stretches from the Tonto Basin to the Mogollon Rim, covering rugged mountain terrain and historic mining districts. The recorder's office handles all property document filing for Gila County. You can search records online through the county's web portals or visit the recorder's office on Ash Street in Globe. Both current and historical property documents are available to the public for research and verification purposes.

Gila County Quick Facts

Gila County Recorder's Office

The Gila County Recorder's Office maintains all property records for the county. The office is located at 1400 E Ash Street in Globe, Arizona 85501. You can reach them by phone at (928) 402-8735. Staff assist with recording new documents and help the public search existing records.

The recorder's website explains services and provides access to online search tools for Gila County property documents.

Recording a standard document in Gila County costs $30. This flat fee covers deeds, mortgages, assignments, releases, and most other property papers. Arizona law sets these fees uniformly across all counties. Plats and surveys have a separate rate of $24 for the first page plus $20 for additional pages. The recorder accepts payment when you bring documents to file. Copies of recorded documents cost $1 per page. Certified copies add a $3 charge for the certification stamp.

Gila County has a mix of property types from town lots in Globe and Payson to large ranches and mining claims in the backcountry. The recorder's office handles documents for all these different property interests. Historic mining claims and patents from the territorial era still appear in the record books. Modern subdivisions in the Payson area generate steady recording activity as development continues.

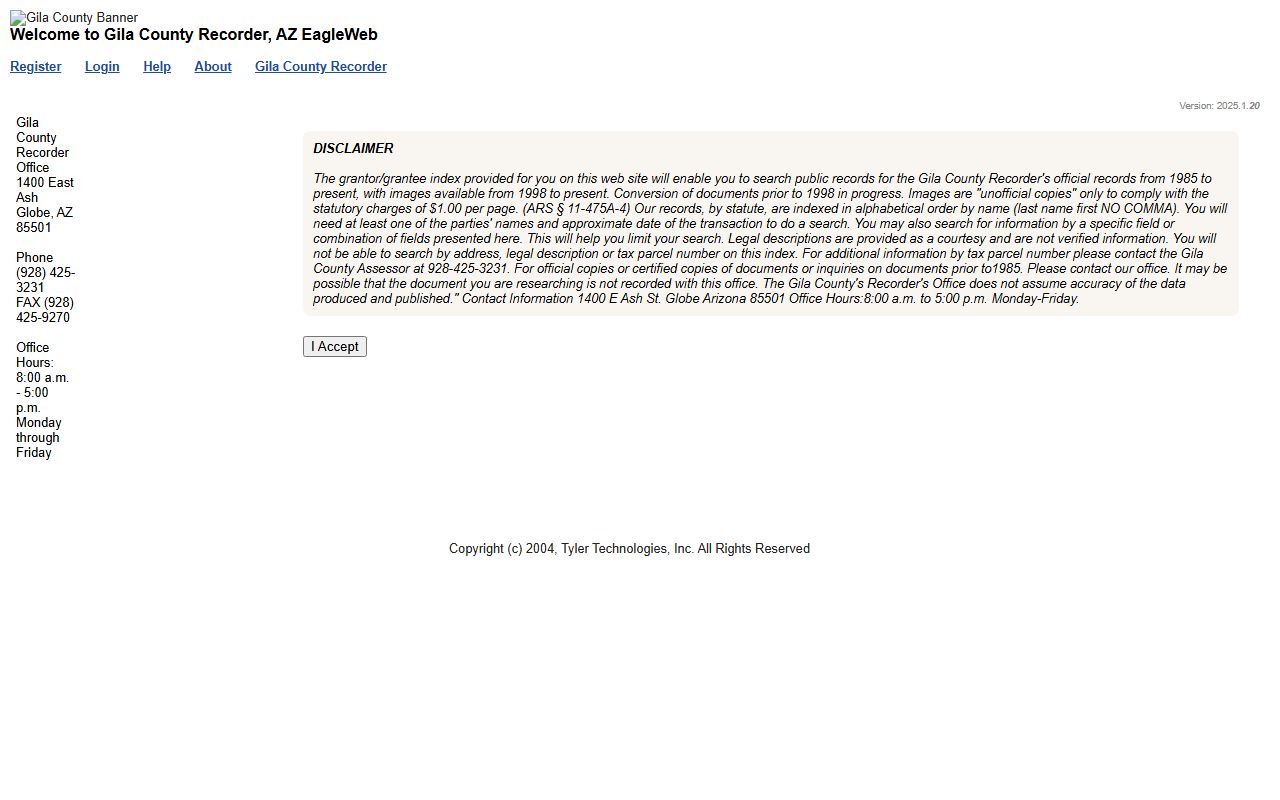

Gila County Document Search

The county provides an online document search portal for public access to recorded instruments. This database lets you search by name, document type, or recording date. Enter the grantor or grantee name to find deeds and other transfers. Results display the recording information and parties involved.

The document search covers recorded instruments in Gila County. You can view basic information and request copies of documents you need.

Searching property records in Gila County helps buyers verify ownership before closing. A title search shows all recorded documents affecting a parcel. This includes deeds showing the chain of ownership, mortgages and deeds of trust encumbering the property, and liens filed by creditors. Judgment liens, mechanic's liens, and tax liens all appear in the recorder's index. Missing any of these could mean buying property with hidden debts. Professional title searches go back many years to catch old problems that could affect current ownership.

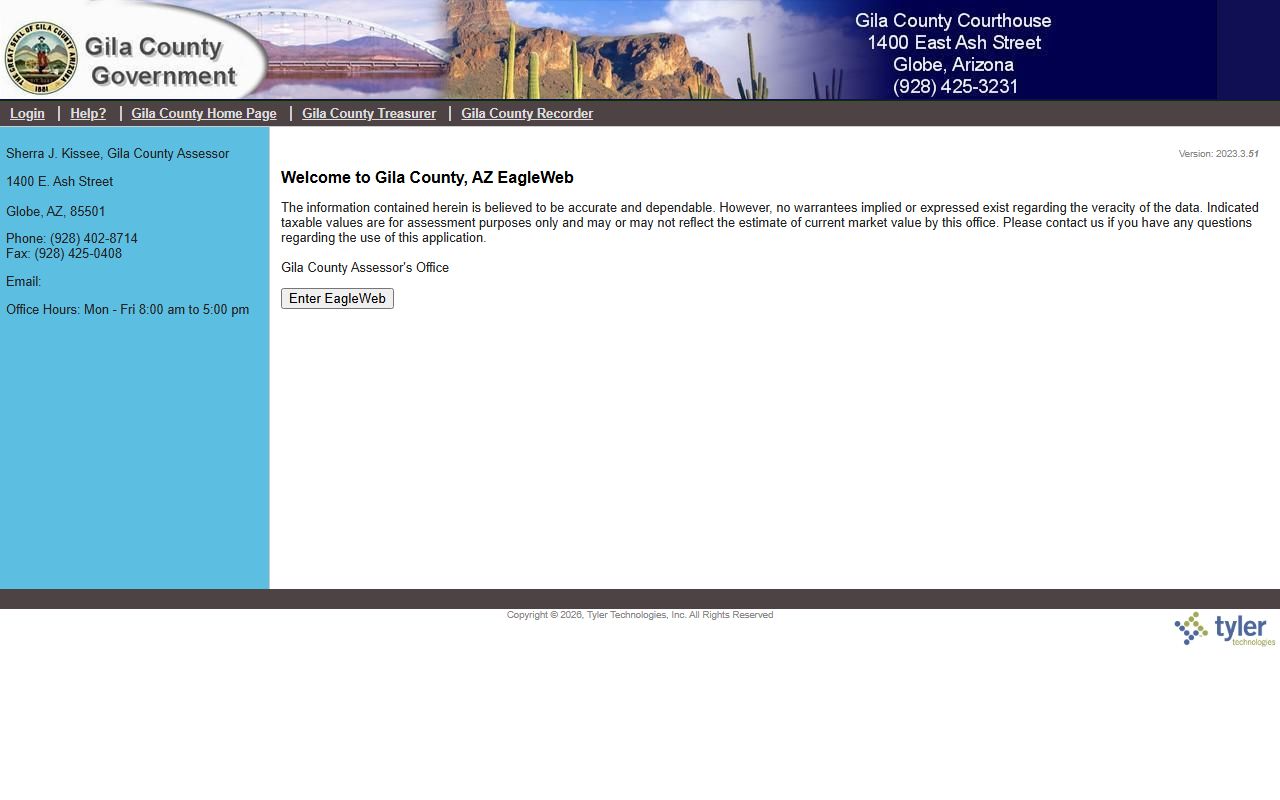

Gila County Property Assessor

The Gila County Assessor's Office handles property valuation for tax purposes. Contact them at (928) 402-8714. The assessor determines the value of every parcel in the county each year. These values form the basis for property tax calculations. Different property types get valued using different methods based on their use.

The assessor's office provides property information and assists owners with questions about their valuations.

Gila County uses the EagleWeb portal for property searches. This system lets you look up any parcel by owner name, address, or parcel number. Search results show ownership, assessed values, and property characteristics. The data includes square footage, lot size, and improvement details. Use this tool to research property values before buying or to verify your own assessment is accurate.

The EagleWeb system provides current property data for all parcels in Gila County. Information updates regularly to reflect recent changes.

Property Records in Gila County

Gila County property records cover many types of real estate interests. Warranty deeds transfer full ownership with guarantees. Quit claim deeds pass whatever interest the grantor has without promises. Special warranty deeds limit the guarantee to the time the seller owned the property. Each serves a different purpose in property transactions.

Deeds of trust secure loans against property. When you get a mortgage in Arizona, the lender takes a deed of trust that gives them the right to sell the property if you default. These recordings show up in the public record. When the loan is paid off, the lender records a release or reconveyance to clear the lien. Checking for unreleased deeds of trust is part of any title search.

Liens can attach to property in several ways. The Arizona Department of Revenue files state tax liens. The IRS records federal tax liens. Contractors who do not get paid file mechanic's liens. Courts issue judgment liens when creditors win lawsuits. All these appear in Gila County property records and must be cleared before the property can transfer with clean title. Lien priority generally follows recording date, so earlier liens get paid first.

Note: Title insurance companies search these records professionally before issuing policies that protect buyers from unknown claims.

Recording Document Requirements

Arizona Revised Statutes set requirements for documents submitted for recording. Under A.R.S. 11-480, each document needs a caption stating what it is. Write "Warranty Deed" or "Deed of Trust" at the top. The recorder uses this to index the document properly. Papers must be originals with legible signatures and proper notarization.

Formatting rules apply to all recordings in Gila County. Documents from 1991 forward need half inch margins on all sides. The first page requires a two inch top margin for the recording stamp. Residential mortgages on one to four unit properties must include "RESIDENTIAL 1-4" in the caption. Failure to meet these requirements can delay recording while you correct the problems.

The Affidavit of Property Value must accompany most deed recordings. A.R.S. 11-1133 requires this form to be attached showing the sale price. Both buyer and seller sign it. Some transfers qualify for exemption including gifts, family transfers, and certain trust conveyances. The exemption code appears on the deed instead of the affidavit when applicable.

Nearby Arizona Counties

Gila County borders multiple other Arizona counties. Properties near county lines require careful attention to determine which county actually holds the records. Always verify the parcel location before searching.

Counties adjacent to Gila include Navajo County to the north, Graham County to the east, Pinal County to the south, Maricopa County to the southwest, and Yavapai County to the west. Each county operates its own recorder's office. Documents must be filed in the county where the land sits regardless of where the owner lives.