Apache County Property Records

Apache County property records contain deeds, mortgages, liens, and other land documents kept by the County Recorder in St. Johns. This is one of Arizona's largest counties by land area, covering vast stretches of northeastern Arizona including parts of the Navajo Nation and the Apache-Sitgreaves National Forests. You can search these records online through the county assessor's EagleWeb portal or visit the recorder's office in person. The recorder handles all official property document filing and retrieval for Apache County residents and property owners.

Apache County Quick Facts

Apache County Recorder's Office

The Apache County Recorder's Office processes and maintains all property documents for the county. The office is at 75 West Cleveland in St. Johns, Arizona 85936. You can call them at (928) 337-7514 for questions about recording or searching records. Hours run Monday through Thursday from 6:30 AM to 5:30 PM. The office is closed on Fridays.

Recording documents in Apache County follows the state fee schedule set by Arizona law. A standard deed, mortgage, or other document costs $30 to record. This flat rate applies to most property papers. Plats and surveys have a different fee structure with $24 for the first page and $20 for each page after that. You should bring exact payment when you visit since not all offices accept credit cards. The recorder's staff will check your documents to make sure they meet state requirements before accepting them for recording.

Apache County is unique because much of its land falls within the Navajo Nation and other tribal areas. Property transactions on tribal land may involve the Bureau of Indian Affairs rather than the county recorder. If you own property on trust land, you need to work with federal agencies instead of or in addition to the county office. Fee simple land within the county follows standard Arizona recording rules.

Search Apache County Property Records Online

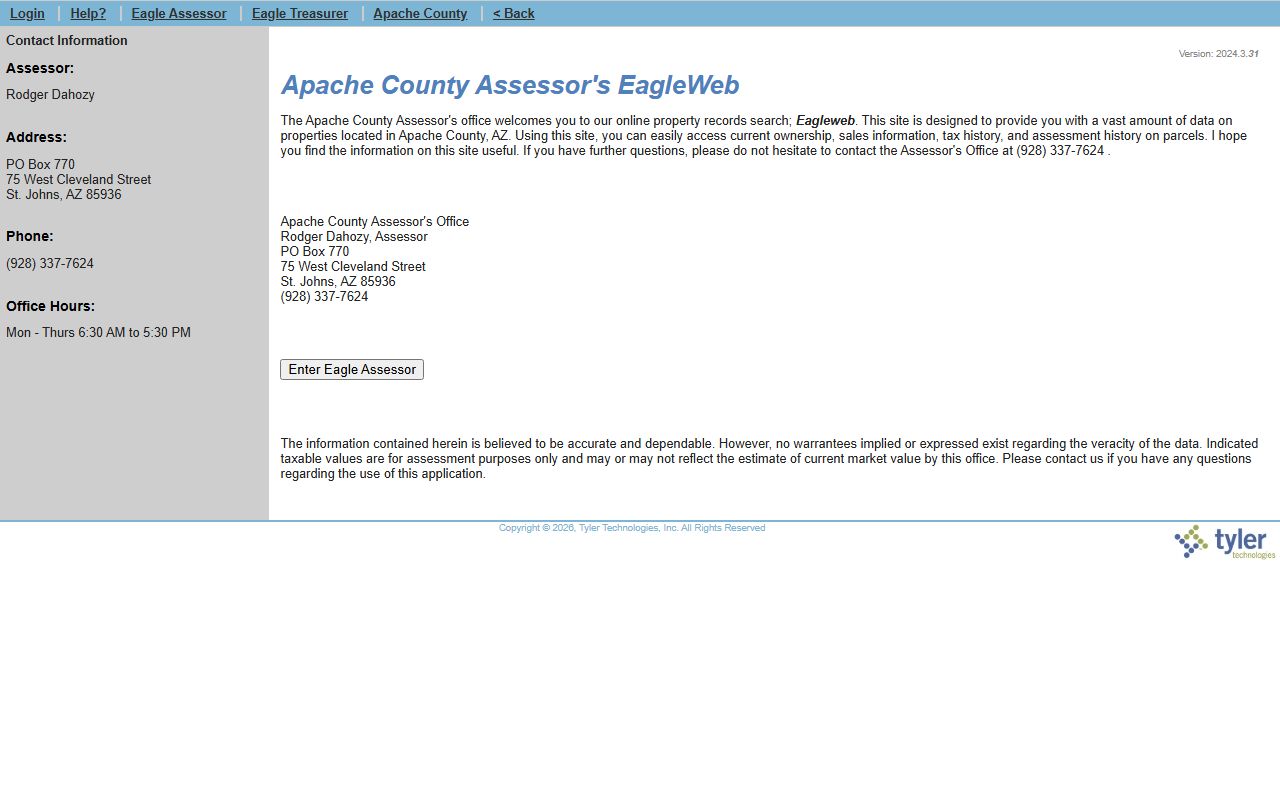

The county provides online access to property records through the EagleWeb search portal. This database lets you look up parcels by owner name, address, or parcel number. You can view property details, ownership history, and assessed values for any parcel in Apache County. The system is free to use and available around the clock.

The EagleWeb system shows current ownership and recent sales data for Apache County parcels. Search results include the parcel number, legal description, and owner of record.

For older records or documents not available online, you may need to visit the recorder's office in St. Johns. The office keeps physical records and can help you find documents that predate the digital system. Staff can also provide certified copies of recorded documents when you need them for legal purposes. Copies cost $1 per page and certification adds $3 more.

Apache County Property Assessor

The Apache County Assessor's Office handles property valuation for tax purposes. You can reach them at (928) 337-7624. The assessor determines the value of all real and personal property in the county each year. These values set the base for property tax calculations.

The assessor's website provides access to property cards and valuation data for parcels across Apache County. You can research a property's assessed value before buying or check your own assessment for accuracy.

If you think your property value is wrong, you can file an appeal with the assessor's office. Arizona law requires you to file within 60 days of receiving your notice of value. Use the state form for real property appeals. The assessor will review your claim and may adjust the value if you provide good evidence. Common reasons for appeals include errors in the property description, incorrect square footage, or sales data that shows a lower market value.

Note: The assessor and recorder are separate offices with different jobs, but both deal with Apache County property records.

Apache County GIS Parcel Viewer

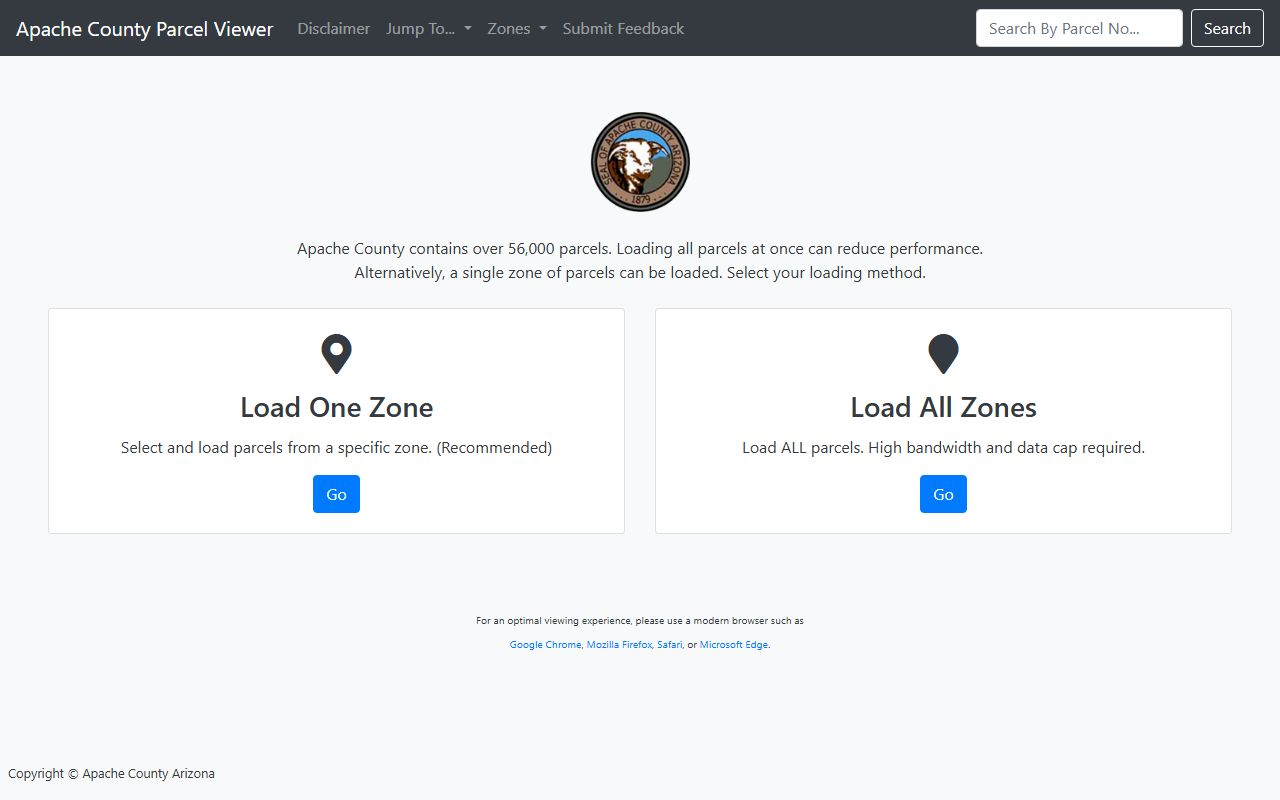

Apache County offers a GIS parcel viewer for mapping and property research. This tool shows parcel boundaries, roads, and geographic features across the county. You can zoom in to see specific properties and their relationship to surrounding land.

The parcel viewer helps you understand where a property sits in relation to roads, water features, and other parcels. This is especially useful in Apache County where many properties are in remote areas without street addresses.

GIS maps complement the official property records from the recorder's office. While maps show where a parcel is located, recorded documents prove who owns it. Use both tools together when researching Apache County property. The viewer can help you identify parcel numbers which you then use to search for recorded documents. Rural properties in Apache County often have large acreages, and the mapping tool helps visualize these big tracts of land.

Recording Requirements in Apache County

Arizona law sets specific rules for documents to be accepted for recording. Under A.R.S. 11-480, each document must have a caption that briefly states its nature, such as warranty deed or deed of trust. Documents must be original and legible enough for the recorder to make certified copies.

Format requirements include margins and spacing rules. Documents executed after January 1, 1991 need at least a half inch margin on all sides. The first page must have a top margin of at least two inches where the recorder stamps recording information. For deeds of trust or mortgages on residential property with one to four units, the caption must include the words "RESIDENTIAL 1-4" in the heading.

Every deed in Apache County needs either an Affidavit of Property Value or an exemption code. This requirement comes from A.R.S. 11-1133. The affidavit must be signed by both the buyer and seller. If your transfer qualifies for an exemption, you note the code on the deed instead. Common exemptions cover transfers between family members, gifts, and certain trust transactions.

Arizona Property Recording Laws

Property recording in Apache County follows Arizona state law. A.R.S. 11-461 establishes the recorder's duty to keep all records, maps, and papers deposited in the office. The recorder must separately record all instruments that law requires or allows to be recorded. This includes deeds, mortgages, liens, releases, and many other document types.

Recording a document gives legal notice to the world. Under A.R.S. 33-411, an unrecorded instrument does not give notice to later buyers or lenders. This means someone who buys property without checking the records might lose out to an earlier unrecorded claim. Recording protects your ownership interest by putting everyone on notice. The recording date and time establish priority when multiple claims exist against the same property.

A.R.S. 33-416 confirms that a properly recorded document serves as legal notice to all persons. Once you record your deed in Apache County, no one can claim they did not know about your interest.

Nearby Arizona Counties

Apache County borders several other Arizona counties. If a property sits near a county line, make sure you search in the correct county's records. The county line determines which recorder's office handles the documents.

Counties that border Apache include Navajo County to the west, Greenlee County to the south, and Graham County to the southwest. Apache County also shares borders with New Mexico to the east. Each county maintains its own recorder's office and property record system. Documents must be recorded in the county where the land is located.