Greenlee County Property Records

Greenlee County property records contain deeds, mortgages, liens, and other documents filed with the County Recorder in Clifton. As the least populated county in Arizona, Greenlee maintains a smaller but well-organized records system. You can search property records by visiting the recorder's office at 253 5th Street or by using the online property search tool. The recorder handles all land document filings for the county. Whether you need to check ownership, find a deed, or research title history, Greenlee County offers both in-person and online access to these public records.

Greenlee County Quick Facts

Greenlee County Recorder's Office

The Greenlee County Recorder's Office handles all property document recording in the county. The office is at 253 5th Street in Clifton. You can call them at (928) 865-2632. Office hours run Monday through Thursday from 7am to 5pm. The office is closed on Fridays.

Recording a deed or other property document in Greenlee County costs $30 per instrument. This is the standard fee set by Arizona law under A.R.S. 11-475. Plats and surveys cost $24 for the first page and $20 for each page after that. Copies run $1 per page, and certification adds $3 to the total. You can pay with cash, check, or credit card at the office.

The Greenlee County Recorder website includes a helpful FAQ section that answers common questions about recording documents and searching records. Staff can help you understand what forms you need and how to prepare your documents for recording. Keep in mind they cannot give legal advice or help you draft documents.

The recorder's FAQ page provides useful guidance for anyone new to property records in Greenlee County.

This page helps answer basic questions about the recording process in Greenlee County.

Greenlee County Property Search

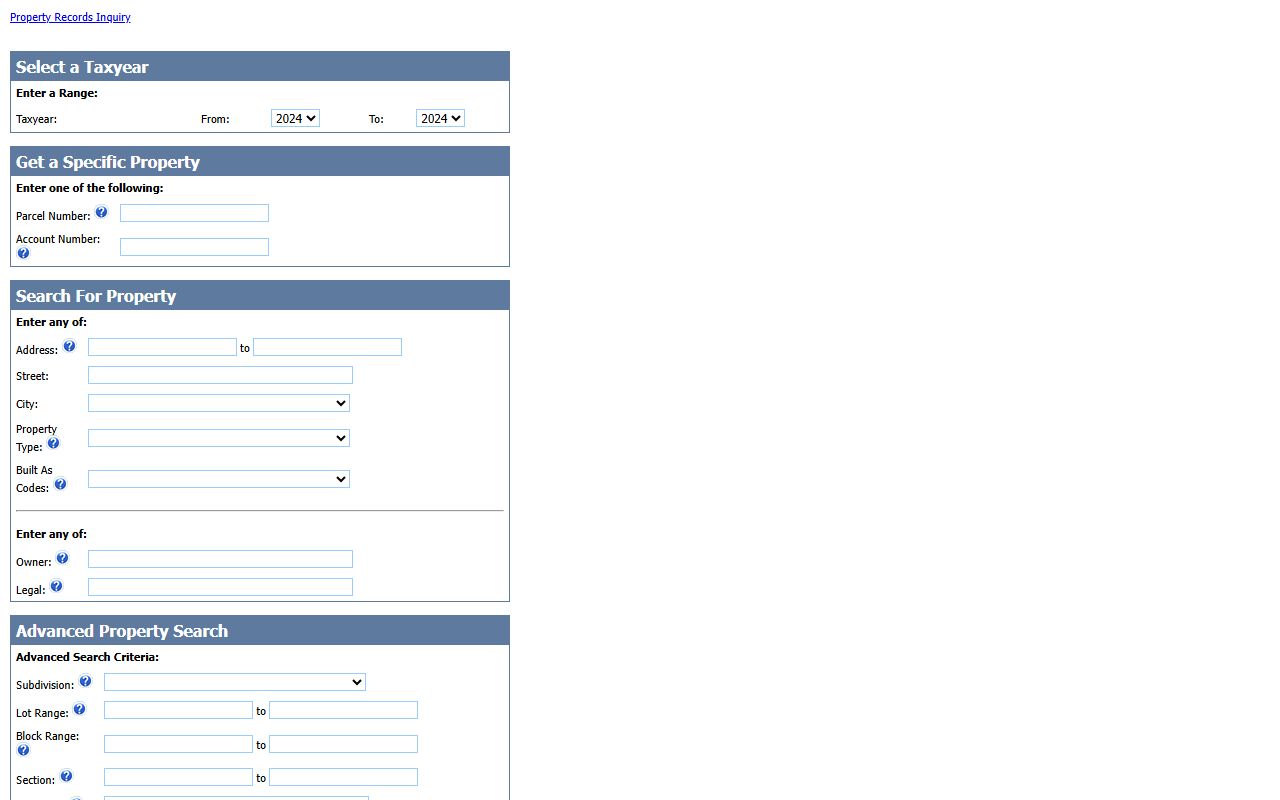

Greenlee County offers an online property search tool through the assessor's office. The Greenlee County property search lets you look up any parcel in the county. Enter an address, owner name, or parcel number to find property details. The search is free and open to the public.

The property search shows assessed values, property descriptions, and ownership information. You can use it to verify who owns a piece of land before making an offer. It also shows the parcel size, land use classification, and tax information. This tool works well for basic research needs.

For recorded documents like deeds and mortgages, you may need to visit the recorder's office in person. Greenlee County does not have a full online document search system like some larger counties. If you need copies of recorded documents, call the office at (928) 865-2632 or stop by during business hours. Staff can help you find what you need.

The online search tool provides quick access to Greenlee County property data.

This database lets you search Greenlee County parcels by address or owner name.

Note: The property search shows current ownership and values but may not include all recorded documents.

Property Recording Requirements

Arizona law sets specific rules for recording property documents. Under A.R.S. 11-480, every deed must include a caption that describes the document type. For example, a warranty deed must say "Warranty Deed" at the top. Documents need at least a half-inch margin on all sides. The first page must have a two-inch top margin reserved for recording stamps.

Deeds transferring property in Greenlee County must include an Affidavit of Property Value or an exemption code. This is required by A.R.S. 11-1133. Without this form, the recorder will reject your deed. Common exemptions include transfers between family members and certain trust transactions. Ask the recorder's office if you are not sure which exemption applies to your situation.

All documents must be originals and clear enough to make certified copies. The recorder cannot accept documents that are too faded or hard to read. If you are recording a deed, make sure the grantor's signature is notarized. Arizona requires all conveyances to be acknowledged before an authorized officer as stated in A.R.S. 33-401.

Greenlee County Property Taxes

The Greenlee County Treasurer collects property taxes for all parcels in the county. Arizona property taxes come due in two installments each year. The first half is due October 1 and becomes late after November 1. The second half is due March 1 and becomes late after May 1. Missing these deadlines results in interest and penalties.

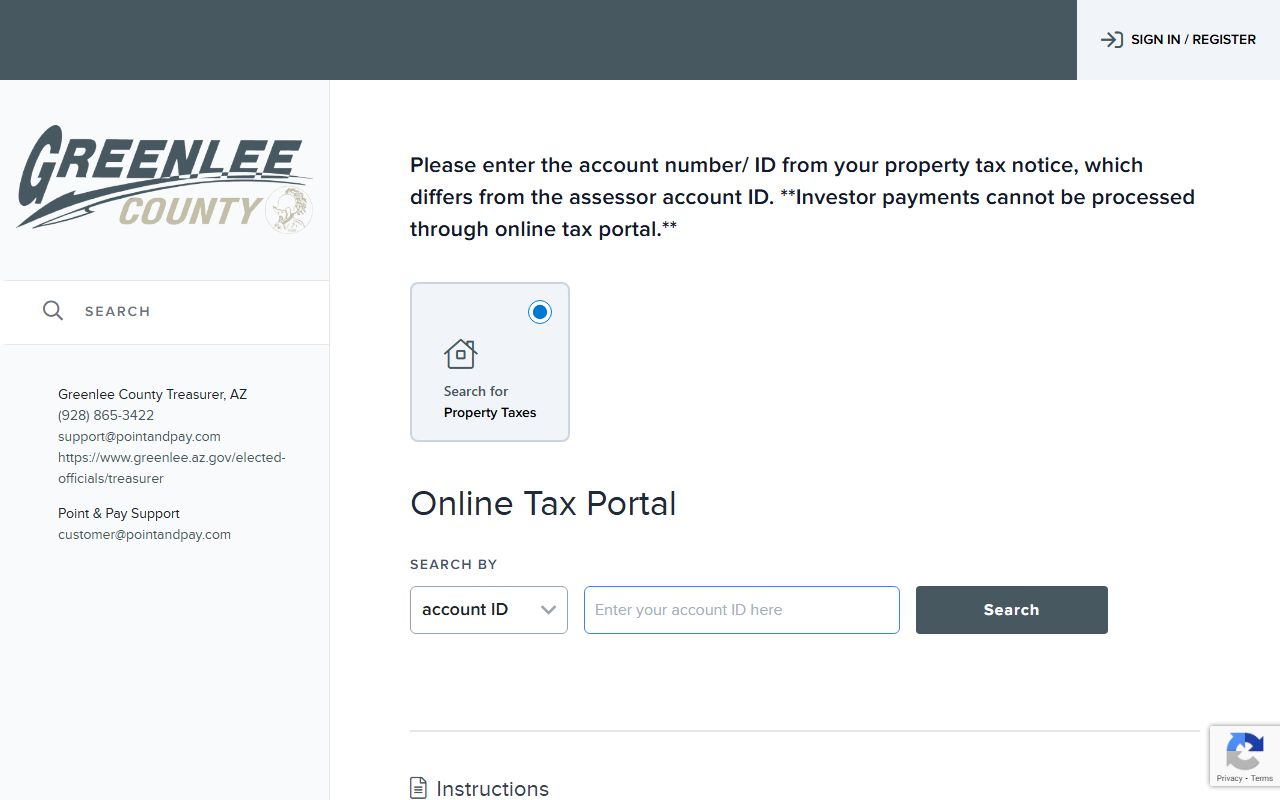

You can pay Greenlee County property taxes online through the Greenlee County tax payment portal. Enter your parcel number to see what you owe. The site accepts credit cards and electronic checks. You can also pay in person at the treasurer's office or by mail.

The online tax payment portal makes it easy to pay from home.

Tax payment records are part of the property record history in Greenlee County. Unpaid taxes can lead to a tax lien on the property. If you are buying land, check that taxes are current before closing.

Property Records and Arizona Law

Recording a deed in Greenlee County protects your ownership rights. Under A.R.S. 33-411, an unrecorded deed does not give notice to later buyers. This means someone else could claim the property if they recorded their deed first. Recording your deed creates a public record that protects your ownership.

Once a document is properly recorded, it serves as legal notice to everyone. A.R.S. 33-416 states that a recorded instrument is notice to all persons of its existence. This is why title companies search recorded documents before closing on a sale. The search reveals any liens, mortgages, or other claims against the property.

The recorder must maintain custody of all records, maps, and papers filed with the office. A.R.S. 11-461 requires the recorder to keep these records safe and available for public inspection. You have the right to view any recorded document during normal business hours.

Greenlee County Assessor

The Greenlee County Assessor values all real and personal property in the county for tax purposes. You can reach the assessor at (928) 865-5302. The assessor determines the full cash value of your property each year. This value is used to calculate your property tax bill.

If you disagree with your assessed value, you can file an appeal. Arizona gives property owners 60 days from the notice date to appeal real property values. Use ADOR Form 82130 for the appeal. Personal property appeals must be filed within 30 days using ADOR Form 82530. The Arizona Department of Revenue provides more information about the appeal process.

The assessor and recorder are separate offices with different jobs. The recorder handles document filing and storage. The assessor determines property values for taxation. Both offices work with property records, but their roles do not overlap.

Nearby Arizona Counties

Greenlee County borders several other Arizona counties. If a property sits near a county line, make sure you search the correct county's records. Land records are filed in the county where the property is located.

Counties that border Greenlee include Graham County to the west and Cochise County to the south. Apache County lies to the north. The state of New Mexico borders Greenlee County to the east. Each Arizona county maintains its own recorder's office and property record system.

Greenlee County is one of Arizona's smallest counties by population. This means smaller files and often faster service at the recorder's office. Rural property records in Greenlee County may include mining claims and large ranches that span many acres.

Note: Always verify which county a property is in before searching records or recording documents.