Yuma Property Records

Yuma property records track ownership and encumbrances on real estate in this southwestern Arizona city near the California and Mexico borders. The Yuma County Recorder's Office handles all document recording, not the city government. You can search these records online through the county's database, which contains deeds, mortgages, liens, and other instruments affecting land. Yuma sits at the confluence of the Colorado and Gila rivers, making it one of Arizona's oldest settled areas with property records stretching back generations. Whether checking title history, researching liens, or verifying ownership, the county recorder provides access to Yuma property documents.

Yuma Quick Facts

Where Yuma Property Records are Filed

All property documents in Yuma are recorded at the Yuma County Recorder's Office. The city of Yuma does not maintain property records. Arizona uses a county-based system where the recorder serves everyone within the county borders.

The Yuma County Recorder's Office is located at 102 S. Main Street in downtown Yuma. David Lara serves as the current recorder. You can call the office at (928) 373-6020 or email Recorder@yumacountyaz.gov. Hours run Monday through Friday from 8:00 a.m. to 5:00 p.m. The office sits in the county government complex, making it easy to access other departments if you need them.

Recording happens three ways. Walk in during business hours and get your document recorded while you wait. Mail your document with payment to the Main Street address. Or use e-recording through approved third-party services. Most title companies and lenders prefer electronic submission for speed and convenience. Military discharge documents have no recording fee, which matters in a community with close ties to military installations.

Note: The recorder's office staff cannot give legal advice or help fill out documents, so have everything ready before you go.

Search Yuma Property Records Online

The county provides an online document search portal for Yuma property records. This database lets you look up deeds, mortgages, releases, and other recorded instruments. Enter an owner name, address, or document number to find what you need. Results show recording dates, document types, and basic information.

Basic searches are free. You can see what documents exist and when they were recorded. Getting copies of actual document images costs a small fee. Copies run $1 per page. Certified copies add $3 for the certification. These fees support the office and help maintain records that serve Yuma residents for generations.

The system runs on Tyler Technologies software, the same vendor many Arizona counties use. This makes searching familiar if you've used other county databases in the state. The Yuma County system includes documents going back decades, though older records may require an in-person visit to review microfiche or physical books. More recent recordings from the past 20 years are reliably online.

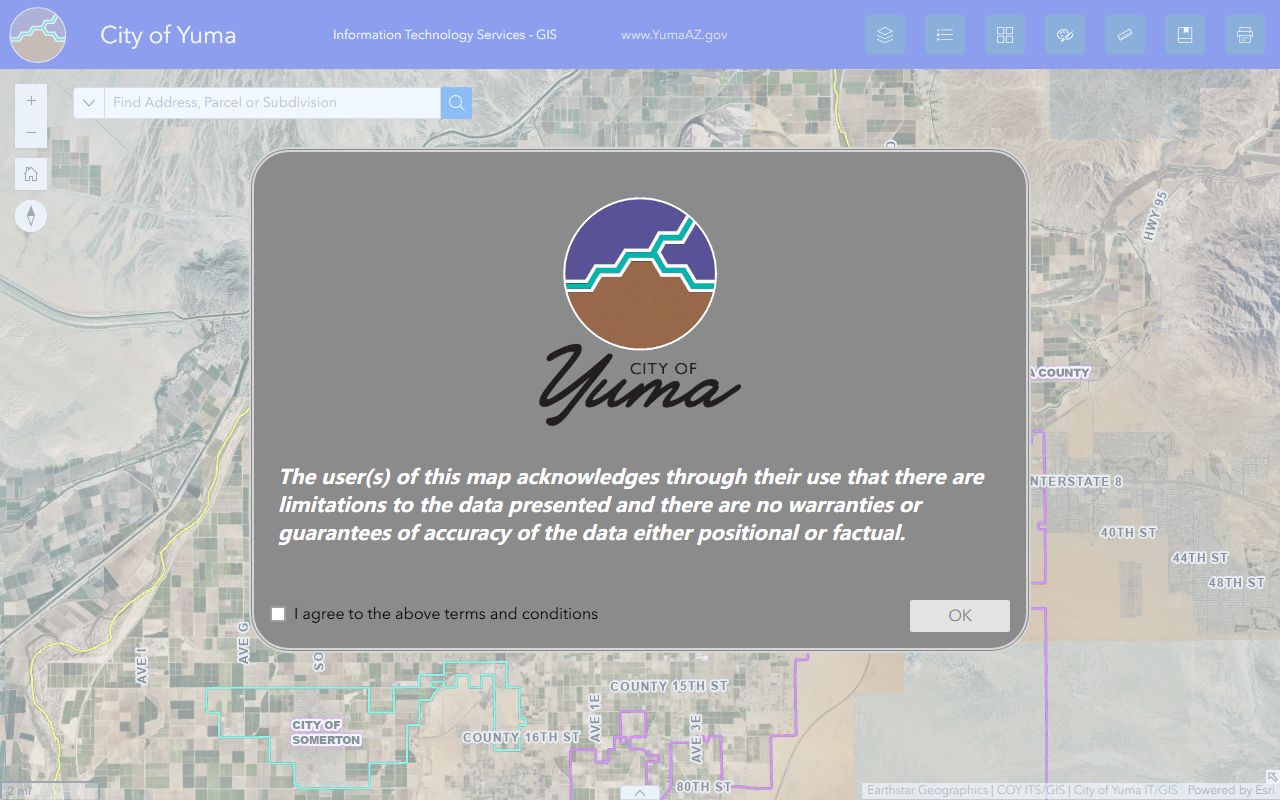

Yuma City GIS and Mapping

The City of Yuma provides its own GIS mapping system at the city GIS portal. This tool shows parcel boundaries, addresses, and land features within city limits. You can look up a property and see its location, lot lines, and surrounding area.

The city GIS complements the county recorder's database. While the recorder tracks who owns what, the GIS shows where it is. The mapping system displays zoning, floodplains, and other geographic information relevant to property owners. When researching Yuma real estate, using both tools gives you the full picture.

Yuma County also maintains a cadastral map showing all parcels countywide. This ArcGIS tool provides another way to explore property boundaries in and around Yuma. The county's GIS data includes rural areas outside city limits that the city map doesn't cover.

Yuma Planning and Development

The city handles its own planning records separate from county property recording. The Yuma Community Planning Department manages zoning, land use, and development in the city. They determine what can be built on each parcel and process applications for variances or special uses.

You can reach the planning office at (928) 373-5175. Building permits go through a different number: (928) 373-5163. The city maintains a development portal where you can check application status and find permit information.

Zoning tells you what activities a property allows. Residential zones have different rules than commercial or industrial. Some properties sit in overlay districts with extra requirements. Before buying or developing in Yuma, check the zoning to confirm your plans are allowed. The planning department can provide verification letters if needed for transactions.

Recording Fees for Yuma Properties

Yuma County follows the state fee schedule under A.R.S. 11-475. Recording fees are consistent across Arizona counties.

Here's what you'll pay:

- Standard documents: $30.00 per instrument

- Government recordings: $15.00 per instrument

- Plats and surveys first page: $24.00

- Additional pages: $20.00 each

- Military discharges: No fee

The recorder accepts various payment methods. Cash works for walk-in recordings. Checks should be payable to Yuma County Recorder. Credit cards are accepted but may have processing fees. For mail submissions, include the exact amount or your document comes back unrecorded.

Note: Fees change when the state legislature updates the statute, so verify current amounts with the recorder's office for large transactions.

Yuma Property Assessments

The Yuma County Assessor determines property values for tax purposes. They assess all real and personal property in the county each year. You can reach the assessor at (928) 373-6040.

The county provides a property search database where you can look up any Yuma parcel. Enter an address or parcel number to see ownership information, lot details, building characteristics, and assessed values. This tool is free to use and helps buyers research properties before making offers.

If you disagree with your assessment, Arizona allows appeals. Contact the assessor within 60 days of your notice to start the process. The appeal examines whether the assessed value reflects fair market value. Many successful appeals come down to comparable sales data showing lower values in the neighborhood.

Property Taxes in Yuma

The Yuma County Treasurer collects property taxes. You can reach them at (928) 539-7781. Taxes are due in two installments each year. The first half is due October 1 and becomes delinquent after November 1. The second half is due March 1 and becomes delinquent after May 1.

The county offers online tax payment through their payment portal. You can search by parcel number, owner name, or address to find your tax bill. The system shows current amounts due, payment history, and delinquent balances. Paying online is convenient and avoids trips to the treasurer's office.

Delinquent taxes lead to serious consequences. Interest and penalties add up monthly. Eventually the county sells a tax lien on the property. An investor buys the lien and earns interest when you pay. If you don't pay, the investor can foreclose. Always check tax status before buying Yuma property. You don't want to inherit someone else's tax problems.

Types of Yuma Property Documents

Several document types appear in Yuma property records searches. Understanding what each one means helps you interpret what you find.

Warranty deeds transfer ownership with promises of clear title. The seller guarantees they own the property and no hidden claims exist. This is the standard deed for most sales. Quit claim deeds transfer whatever interest the grantor has without any guarantees. People use these for transfers between family members, fixing title issues, or adding spouses to title.

Deeds of trust secure loans in Arizona. When you finance a Yuma home, the lender records a deed of trust against the property. This creates a lien that stays until you pay off the loan. Once paid, the lender records a reconveyance to release its interest. Searching these documents shows what loans encumber a property and whether they've been paid off.

Liens from other sources affect Yuma properties too. Mechanic's liens come from unpaid contractors who worked on the property. Judgment liens result from court awards against the owner. HOA liens arise from unpaid assessments. Tax liens come from unpaid property taxes. All these cloud title and must be resolved before selling. Under A.R.S. 33-411, recording provides legal notice to the world, so anyone buying must deal with recorded liens.

Requirements for Recording in Yuma

Documents filed in Yuma County must meet state recording standards. A.R.S. 11-480 sets the form requirements. Each document needs a caption at the top stating what it is, like "Warranty Deed" or "Release of Lien." Margins must be at least half an inch on all sides. The top of the first page needs two inches of clear space for the recorder's stamp and information.

Deeds transferring Yuma property require either an Affidavit of Property Value or exemption code under A.R.S. 11-1133. This affidavit reports the sale price to the assessor. Exemptions apply to certain transfers like gifts between family members or transfers to trusts. Without the affidavit or valid exemption code, the recorder rejects the deed.

All deeds must be signed and properly notarized. A.R.S. 33-401 requires acknowledgment before a notary or other authorized officer. The notary verifies the signer's identity and witnesses their signature. Documents lacking proper notarization are rejected. Make sure your notary completes the acknowledgment certificate correctly with all required information.

Nearby Arizona Cities

Yuma is somewhat isolated in Arizona's southwest corner. The nearest major Arizona cities are far away. San Luis sits just south near the border. Somerton is another nearby community. But these are smaller towns without their own property pages here.

For other large Arizona cities with property records information, see Phoenix, Tucson, or Mesa. These are in different counties and use different recorder offices. If you're looking at property throughout Arizona, each county has its own recording system you'll need to search separately.