Yuma County Property Records

Yuma County property records cover all land documents filed in Arizona's southwest corner. The recorder's office maintains deeds, mortgages, liens, and other papers that affect real estate ownership throughout the county. You can search these property records through their online database or visit the office in Yuma. The county sits along the Colorado River at the California and Mexico borders, with a mix of agricultural land, residential areas, and desert terrain. Whether you need to verify ownership, find a lien, or research title history, Yuma County provides public access to the property records you need.

Yuma County Quick Facts

Yuma County Recorder's Office

The Yuma County Recorder's Office handles all property document recording in the county. David Lara serves as the current recorder. The office records and maintains public documents that establish ownership, liens, and other interests in real property.

The recorder's office is at 102 S. Main Street in Yuma. This downtown location is in the heart of the city's government center. Office hours run 8:00 AM to 5:00 PM on weekdays. You can call (928) 373-6020 with questions or email Recorder@yumacountyaz.gov for general inquiries.

You can record documents in person during business hours. Walk-ins are welcome and no appointment is needed. You can also mail documents to the Main Street address with the correct fees. For faster processing, use e-recording through approved vendors. Most title companies and mortgage lenders submit documents electronically, which speeds up the process and reduces errors.

The recorder's office cannot give legal advice. Staff will tell you if a document meets recording requirements, but they cannot prepare documents or advise you on what forms to use. If you need help drafting a deed or other paper, work with an attorney or title company before bringing it to record.

Yuma County Document Search

Search recorded documents through the Yuma County document search portal. This online database lets you look up property records by name, document type, or recording date. The system uses Tyler Technologies software, the same platform many Arizona counties use.

The search portal shows recording information and lets you view document details for Yuma County property records.

Basic searches are free. You can see what documents exist and when they were recorded. The database includes deeds, mortgages, liens, releases, and other recorded papers. Results show recording dates, document numbers, and parties involved. If you need copies, fees apply based on the state schedule.

The online system is updated regularly as new documents get recorded. This makes it useful for title searches and ownership verification. Real estate agents, lenders, and title companies use this database daily to check property titles in Yuma County.

For more information about the recording process and common questions, check the Yuma County Recorder FAQ page. This covers topics like what documents can be recorded and how long processing takes.

Recording Fees in Yuma County

Yuma County follows the state fee schedule for recording under A.R.S. 11-475. Standard documents cost $30 to record. This flat fee applies to deeds, mortgages, releases, and other common papers. The fee is the same whether your document is one page or multiple pages.

Plats and surveys have separate pricing. The first page costs $24. Each additional page is $20. Government agencies pay reduced rates when they request recording. Military discharges are recorded at no fee, which is a benefit for veterans in Yuma County.

You must include either an Affidavit of Property Value or an exemption code with any deed transferring property. Arizona law requires this form to track real estate sale prices. Common exemptions include gifts between family members and certain trust transfers. Without the proper form or code, your deed will be rejected.

Note: Bring exact payment or a check. The recorder's office may have limited ability to make change for cash payments.

Yuma County Property Assessor

The Yuma County Assessor values property for tax purposes. Call (928) 373-6040 with assessment questions. The assessor determines property values used to calculate tax bills for all real and personal property in the county.

You can search property details through the Yuma County property search portal. Enter an address or parcel number to see ownership info, property characteristics, and assessed values. The system shows lot size, building square footage, year built, and other details.

The property search shows detailed information for any parcel in Yuma County, including values and ownership data.

The assessor's records complement what the recorder stores. While the recorder has deeds and legal documents, the assessor tracks current ownership, property details, and values. Use both resources for complete property research. The assessor can tell you what a property is worth, while the recorder can show you the legal chain of title.

If you disagree with your assessed value, you can file an appeal. Arizona law gives you 60 days from your notice date to appeal real property values. The assessor's office can provide forms and explain the appeal process. Many owners successfully get values adjusted through appeals.

Property Taxes in Yuma County

The Yuma County Treasurer collects property taxes. Phone (928) 539-7781 for tax questions. The treasurer sends tax bills and processes payments for all real property in the county.

Arizona property taxes are paid in two installments each year. The first half is due October 1. If you do not pay by November 1, it becomes delinquent and interest starts. The second half is due March 1. Miss the May 1 deadline and penalties apply. Paying on time saves you money and keeps your property clear of tax liens.

You can pay taxes online through the Yuma County tax payment portal. The site accepts credit cards and electronic checks. You can also pay by mail or in person at the treasurer's office. Check your payment options before the due date to avoid delays.

Tax records show the payment history for any property. This information is useful when buying real estate. Verify that taxes are current before closing. Delinquent taxes become liens on the property and can lead to tax lien sales if unpaid for several years. The new owner inherits any tax debt, so checking is important.

Yuma County GIS Maps

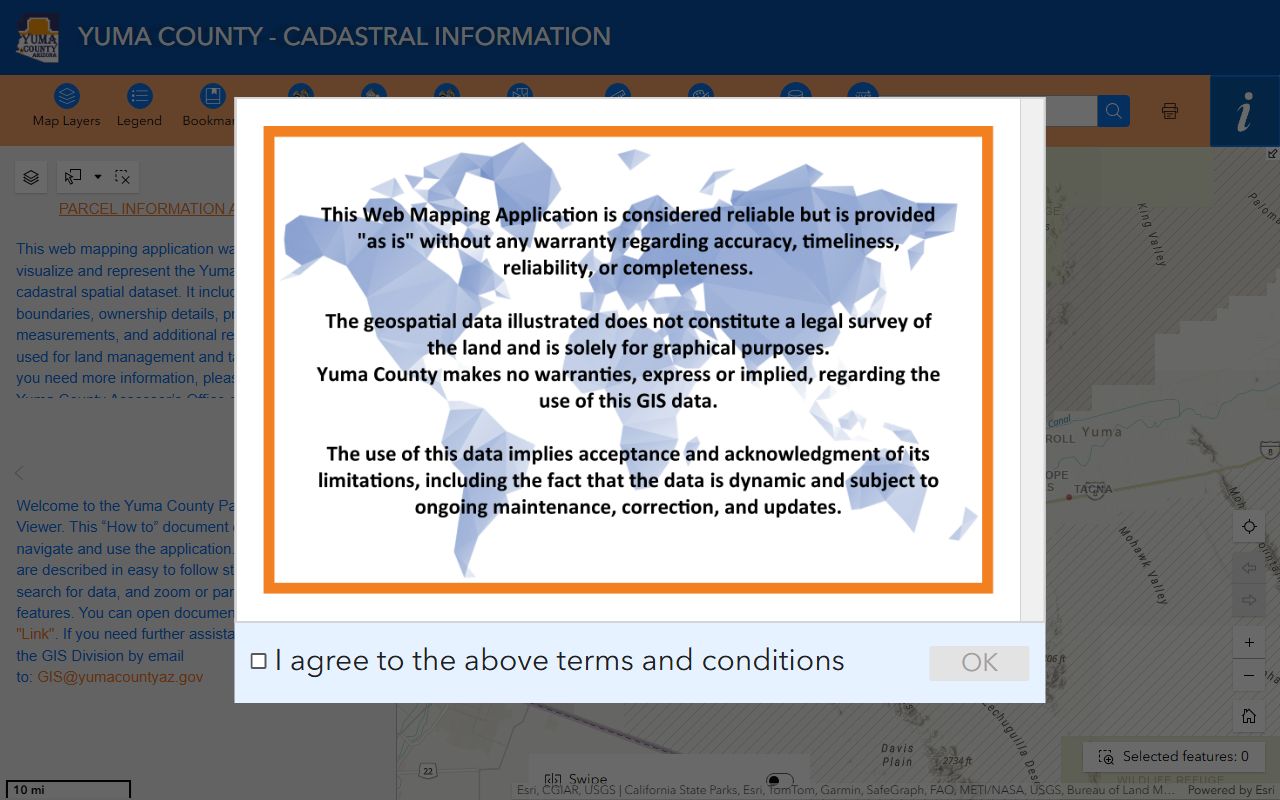

The county provides GIS mapping through the Yuma County Cadastral Map. This interactive viewer shows parcel boundaries, addresses, and land features across the county. You can search by address or navigate the map to find properties.

The cadastral map displays parcel boundaries and property information for Yuma County land.

GIS maps help you visualize where a property sits and what surrounds it. You can see neighboring parcels, roads, irrigation canals, and other features. The aerial imagery shows current conditions on the ground. This is especially useful in Yuma County where agricultural land and water rights are important factors in property value.

Map data is for reference only. Legal property boundaries come from recorded surveys and legal descriptions in deeds. If you need exact boundary information for legal purposes, hire a licensed surveyor to verify the lines.

Cities in Yuma County

Yuma County contains the city of Yuma and several smaller communities. Property recording for all cities in the county goes through the Yuma County Recorder. Cities handle permits and zoning, but property documents are filed at the county level.

Yuma is the county seat and largest city. It sits near the confluence of the Colorado and Gila rivers. The Yuma County Recorder's Office is located in downtown Yuma, making it convenient for city residents to handle property record business. The city has grown steadily and continues to see new development.

Smaller communities in Yuma County include San Luis, Somerton, and Wellton. These towns range from border communities to agricultural centers. All property records for these areas are filed with the Yuma County Recorder in Yuma. There are no separate recording offices at the city or town level.

Note: Some areas in Yuma County have unique considerations like agricultural water rights that may require additional research beyond standard property records.

Nearby Arizona Counties

Yuma County borders other Arizona counties and has international and state boundaries. If you are researching property near a county line, make sure you search in the correct county's records.

Counties that border Yuma include La Paz County to the north and Maricopa County to the northeast. Pima County lies to the east. Yuma County also borders California to the west and Mexico to the south. Each Arizona county maintains its own recorder's office and property record system.

Properties near county lines may appear to be in one county but actually fall in another. Use the county GIS maps or assessor lookup to verify which county a property is in before searching records. This can save you time and ensure you find the right documents.