Flagstaff Property Records

Flagstaff property records document real estate ownership in this mountain city of northern Arizona. The Coconino County Recorder maintains all deeds, mortgages, liens, and easements for Flagstaff properties. You can search these records online through the county system. Flagstaff sits at nearly 7,000 feet elevation and serves as home to Northern Arizona University. The city has a mix of older homes near downtown, student housing near campus, and newer developments on the edges. Property records reveal the history of each parcel, from original land patents to recent sales. Whether you want to verify ownership or check for liens, the county database makes Flagstaff property records accessible.

Flagstaff Quick Facts

Recording Flagstaff Property Documents

Property documents for Flagstaff are recorded at the Coconino County Recorder's Office. The city itself does not record deeds. Arizona law places this responsibility with county recorders, so all deeds, mortgages, and liens for Flagstaff real estate go through the county office.

The Coconino County Recorder's Office is located at 110 East Cherry Avenue in Flagstaff. Patty Hansen serves as the county recorder. Office hours are Monday through Friday from 8:00 AM to 5:00 PM. You can record documents in person during those hours. The local office is convenient for Flagstaff residents unlike many Arizona cities where the county seat is far away.

Contact the recorder at 928-679-7850 or toll free at 800-793-6181. Mail recording works for those who cannot visit in person. E-recording through approved vendors offers the fastest option for title companies and frequent filers. Electronic submissions become searchable immediately after processing.

Note: The recorder's office maintains document images dating back to March 1999, with map records going back to 1891.

Search Flagstaff Property Records Online

The Coconino County document search lets you look up Flagstaff property records from any computer. Search by grantor name, grantee name, or instrument number. The system returns matching documents with recording dates and document types.

Basic name searches are free. The database shows what documents exist without charge. Viewing actual images costs money. Copies run $1.00 per page. Add $3.00 for certification if you need an official copy for legal use. These fees help maintain the records system.

Flagstaff properties often have interesting histories. Older homes downtown may have changed hands many times over a century. The recorder's map records stretch back to 1891, covering the era when Arizona was still a territory. Properties near the university show patterns of investor ownership and rental conversions. Each transaction adds to the recorded history.

Flagstaff Planning and Permit Records

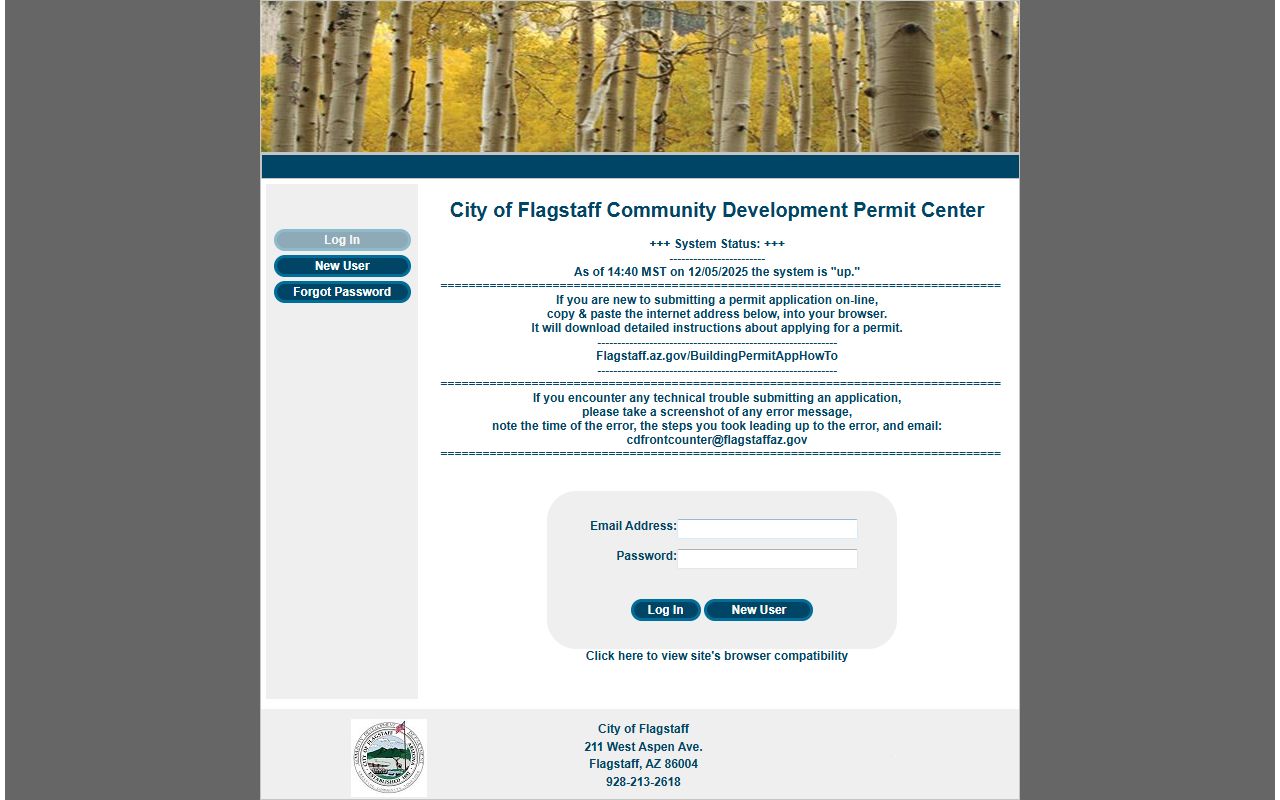

The City of Flagstaff maintains its own planning and development records separate from the county. The Flagstaff Planning and Development Services department handles zoning, permits, and development review. Reach them at 928-213-2000 or email BuildingPermits@flagstaffaz.gov.

Flagstaff's Citizen Access portal provides online lookup for permits and code enforcement cases. Search by address to see what permits have been issued for a property.

The planning department website offers forms, applications, and information about the development process. Building permits, conditional use permits, and variance requests all go through this office. The staff can explain zoning rules for any Flagstaff address and help you understand what uses are allowed.

The city's zoning map shows current zoning designations throughout Flagstaff. You can click on any parcel to see its zone and allowed uses.

This portal displays permit details including permit type, status, issue date, and inspection results. Property buyers use it to verify that renovations or additions were properly permitted. Investors check permit history before purchasing rental properties. The online access saves trips to city hall for basic research.

Requirements for Flagstaff Property Documents

Documents recorded for Flagstaff properties must meet Arizona requirements. A.R.S. 11-480 sets the standards. Each document needs a caption stating its type. Warranty deed, deed of trust, release, and similar descriptions must appear prominently. Margins must be at least one half inch on all sides. Leave two inches clear at the top of the first page for recording information.

Deeds transferring Flagstaff property require an Affidavit of Property Value or exemption code. A.R.S. 11-1133 mandates this for sales transactions. The affidavit reports the sale price to help the assessor track market values. Common exemptions cover transfers between spouses, gifts to family, and trust transfers. Without proper documentation, the recorder will reject your deed.

All deeds must be signed by the grantor and acknowledged before a notary or other authorized officer. A.R.S. 33-401 requires this acknowledgment. The notary verifies the signer's identity and witnesses their signature. Missing or defective acknowledgments mean the document cannot be recorded.

Flagstaff Property Recording Fees

Recording fees for Flagstaff documents follow the state schedule in A.R.S. 11-475. Arizona switched to flat fees in July 2019. Most documents now cost $30 to record regardless of page count.

Fee schedule at Coconino County Recorder:

- Basic document recording: $30.00 flat fee

- Plats and surveys first page: $24.00

- Additional pages for plats: $20.00 each

- Copies: $1.00 per page

- Certification: $3.00 additional

The office accepts payment by cash, check, or credit card. For mail submissions, send a check payable to Coconino County Recorder. Include the exact fee amount with your document. Documents with insufficient fees will be returned unrecorded.

Flagstaff Property Valuations

The Coconino County Assessor sets property values for Flagstaff. The assessor's office values every parcel in the county for property tax purposes. Contact them at 928-679-7962 with questions about valuations or appeals.

The EagleWeb portal lets you look up Flagstaff property information online. Enter an address or parcel number to find owner name, assessed value, lot size, and building details. The system is free to use and provides quick answers about any Flagstaff property.

Property taxes go to the Coconino County Treasurer. You can pay online through the county payment portal. First half taxes are due October 1 and delinquent after November 1. Second half is due March 1 and delinquent after May 1. Seriously delinquent properties can be sold at the annual tax lien auction.

Note: Flagstaff property values tend to be higher than much of rural Arizona due to limited buildable land and strong demand.

Title Searches for Flagstaff Real Estate

A title search examines all recorded documents affecting a Flagstaff property. It confirms ownership and reveals liens, easements, and restrictions. Title companies run these searches before every closing. Mortgage lenders require them as a condition of funding.

The county database lets you run basic searches yourself. Enter a name or use the parcel viewer to find documents. But thorough title examinations go beyond the recorder's index. Professionals check court records for judgment liens, federal tax liens, and pending lawsuits. They verify that the legal description actually describes the land you think you're buying.

Flagstaff's mountain setting creates some unique title issues. Some older properties have access easements across national forest land. Mining claims and water rights can complicate titles in certain areas. Properties near the ski resort may have special use restrictions. A careful title search catches these issues before closing.

Flagstaff Property Mapping Resources

Coconino County offers several mapping tools for property research. The Parcel Viewer shows property boundaries, ownership, and assessed values on an interactive map. Click any parcel to see its details.

The Coconino Open Data portal provides GIS data downloads for researchers and professionals. You can access parcel boundaries, zoning layers, and other geographic information. These resources help anyone analyzing Flagstaff real estate at a larger scale.

The city's zoning map integrates with the county parcel data to show both property boundaries and land use designations. Developers and investors use these tools to identify potential sites. Homebuyers use them to understand what might be built near their property. The visual interface makes complex property information easier to understand than text records alone.

Common Flagstaff Property Document Types

Several document types appear in Flagstaff property searches. Warranty deeds transfer ownership with a guarantee of clear title. The seller promises to defend against any claims. These are standard for home sales. Quit claim deeds transfer whatever interest the grantor has without any warranty. People use them for transfers between family members or to clear up title questions.

Deeds of trust secure loans on Flagstaff property. Arizona uses deeds of trust rather than mortgages for most home loans. A trustee holds the title until the loan is paid off. Then the lender records a full reconveyance to release its claim. If the borrower defaults, the trustee can sell the property through a nonjudicial foreclosure process.

Other recorded documents include easements for utilities or access, declarations of covenants for subdivisions, and liens from unpaid debts. Mechanic's liens protect contractors who were not paid. Tax liens appear when property taxes go unpaid. Judgment liens result from court cases. Each document affects the property's title in some way.

Nearby Arizona Cities

Flagstaff is the largest city in northern Arizona. It serves as the county seat for Coconino County, which is the second largest county by area in the United States. Most nearby communities are small towns or unincorporated areas.

The closest major cities are far to the south in the Phoenix metropolitan area. Phoenix is about 145 miles south via Interstate 17. Scottsdale, Mesa, and other valley cities are similar distances away. Lake Havasu City in Mohave County is roughly 200 miles southwest. For property recording purposes, Flagstaff residents use their local Coconino County office rather than traveling to these distant cities.