Find Peoria Property Records

Peoria property records show who owns land in this growing northwest valley city. These documents include deeds, mortgages, liens, and easements recorded with Maricopa County. The county recorder's office in Phoenix maintains all property records for Peoria. You can search the database online through the county website. The system holds over 50 million documents dating back to 1871. Peoria has grown fast in recent decades, with new subdivisions spreading into the desert. This means lots of recent property transfers are in the records. Whether you're buying a home, selling land, or researching a parcel, the county's online tools give you access to Peoria property records.

Peoria Quick Facts

Where Peoria Property Records are Filed

All property documents for Peoria are recorded at the Maricopa County Recorder's Office. Peoria city hall does not handle deed recording. This is how Arizona structures county government. The recorder serves everyone within county borders, and Peoria falls entirely in Maricopa County.

The Maricopa County Recorder's Office is at 301 W Jefferson St, Suite 200 in downtown Phoenix. That's about 20 miles southeast of most Peoria neighborhoods. The office opens Monday through Friday from 8:00 AM to 5:00 PM. You can walk in without an appointment. Staff process documents while you wait when you record in person.

If you don't want to drive to Phoenix, you can mail documents to the recorder's office. Include the recording fee as a check. The office will record your document and mail back the original within 2 to 4 weeks. Most Peoria title companies use e-recording, which files documents electronically and processes them instantly.

Search Peoria Property Records Online

The Maricopa County document search portal gives online access to Peoria property records. You can search by name, address, parcel number, or legal description. The system returns matching documents with recording dates and document types.

Basic searches cost nothing. You can see document summaries and recording information for free. Viewing actual document images has a small fee. Certified copies cost more. The recorder uses these fees to maintain the database that serves Peoria and all other county residents.

Peoria has many newer subdivisions with detailed records. HOA declarations, subdivision plats, and CC&Rs are all recorded documents. When you search a Peoria address, you may find these community documents along with deeds and mortgages. Understanding what restrictions apply to a property matters, especially in planned communities with strict rules.

Note: Online records are indexed by how names and addresses appear on the original documents, so try different search variations.

Peoria Planning and Zoning Records

While property deeds go to the county, Peoria handles its own planning and development records. The Peoria Planning and Zoning department manages land use applications, zoning cases, and development plans. Call them at (623) 773-7225 with questions.

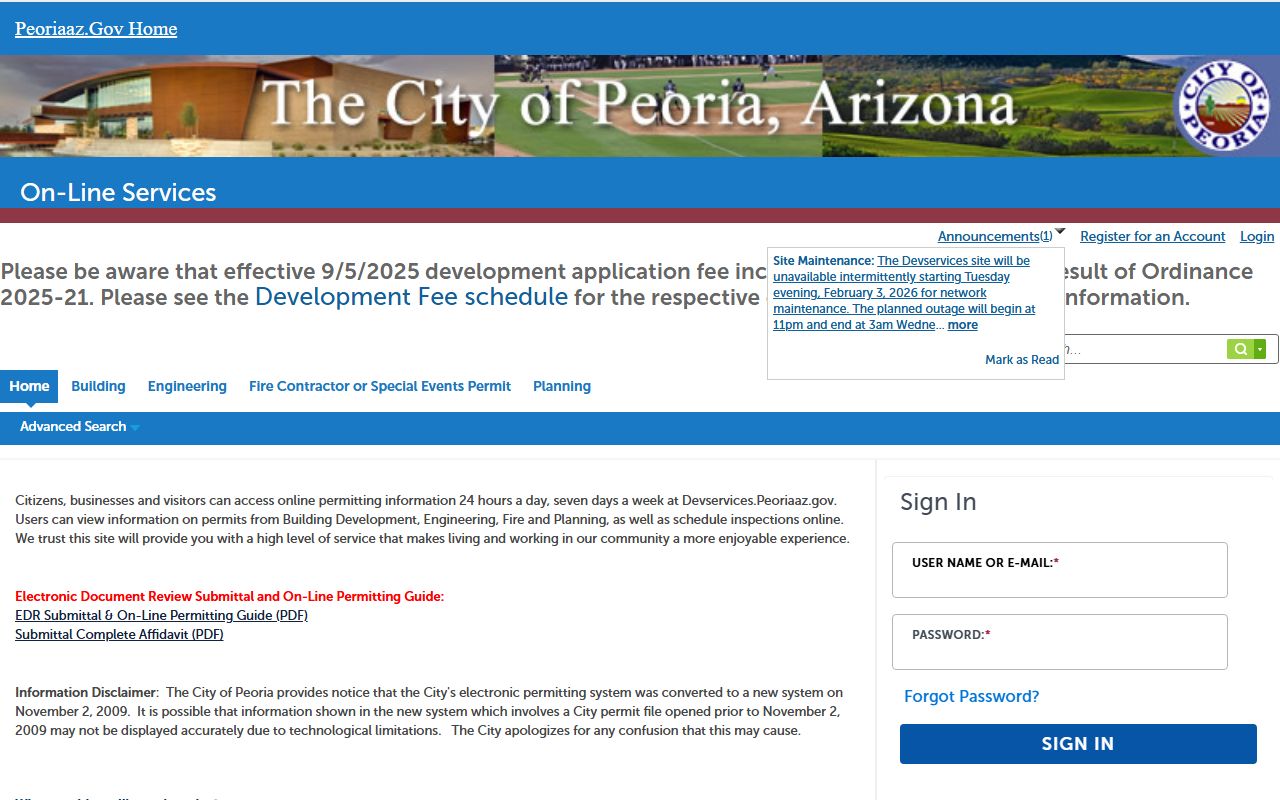

Peoria's Development Services Portal provides online access to permits and applications. This system shows what development activity is happening at any Peoria address.

The portal lets you look up building permits, check inspection status, and find approved site plans. If you're researching a Peoria property, this tool shows what construction has been permitted and inspected. New home buyers often use it to verify the seller pulled proper permits for additions or improvements. Unpermitted work can cause problems at resale.

Planning records tell you what can be built on a parcel. Zoning determines allowed uses, building heights, and lot coverage. Peoria has residential, commercial, and mixed-use zones. Some areas have special overlay districts with extra requirements. The planning department can explain what restrictions apply to any address.

Recording Fees for Peoria Properties

Recording fees in Peoria follow the state schedule under A.R.S. 11-475. The standard fee is $30 per document. This flat rate applies to deeds, mortgages, liens, releases, and most other instruments.

Additional fees include:

- Standard recording: $30.00

- Government agency recordings: $15.00

- Copies: $0.50 to $1.00 per page

- Certified copies: Additional $1.50 to $3.00

The recorder accepts cash, checks, and credit cards. When mailing documents, include a check payable to Maricopa County Recorder. Make sure you include the exact fee. The office will return documents without recording if the fee is wrong.

Types of Peoria Property Documents

Several document types affect Peoria real estate. Warranty deeds are the most common for home sales. They transfer ownership and guarantee the seller has clear title. Quit claim deeds transfer whatever interest the grantor has without guarantees. Special warranty deeds fall in between. All must be recorded to give public notice under A.R.S. 33-416.

Deeds of trust secure home loans in Arizona. When you finance a Peoria home, the lender records a deed of trust against the property. This gives them the right to foreclose if you stop paying. When you pay off the loan, the lender records a reconveyance to release the lien. Searching for these documents shows what loans are against a property.

Liens can come from many sources. The IRS and state can file tax liens. Contractors who don't get paid can file mechanic's liens. Courts record judgment liens when someone wins a lawsuit. HOAs can lien properties for unpaid dues. All these show up in the county database. A thorough title search checks for all lien types before closing.

Peoria Property Assessments and Taxes

The Maricopa County Assessor determines property values for Peoria. The assessed value drives your annual tax bill. You can look up any Peoria property through the county parcel viewer. Enter an address or click on the map to see ownership and value details.

Property taxes go to the Maricopa County Treasurer. Peoria residents pay in two installments each year. The first half is due October 1 and delinquent after November 1. The second half is due March 1 and delinquent after May 1. The county adds interest and penalties to late payments.

Peoria property owners who disagree with their assessed value can appeal. File within 60 days of your notice of value. Use ADOR Form 82130 for real property appeals. You'll need evidence that your property is worth less than the assessor says. Comparable sales from the area make the best evidence.

Note: Assessments are based on full cash value, but you only pay taxes on the limited property value, which is lower.

Title Searches in Peoria

A title search reviews all recorded documents affecting a Peoria property. It traces ownership through the chain of deeds. It checks for mortgages, liens, easements, and restrictions. Title companies perform these searches before every real estate closing to make sure buyers get clear title.

You can do basic research yourself through the county database. Enter an owner name or address and see what comes up. But professional title searches go deeper. They check for judgments, tax liens, and anything recorded against current and former owners. They verify the legal description matches the property you think you're buying.

Peoria's newer subdivisions usually have clean title histories. The original developer recorded the plat and sold lots to builders who sold to homeowners. There are only a few transfers to track. Older properties in central Peoria may have longer, more complicated histories with more documents to review.

Nearby Arizona Cities

Peoria sits in the northwest valley of metro Phoenix. The city stretches from older neighborhoods near Phoenix to new development pushing into the desert. Several other large cities are nearby, all using the same Maricopa County recorder for property documents.

Neighboring cities include Glendale to the southeast, Phoenix to the south and east, and Surprise to the west. Goodyear is further southwest. Some Peoria addresses sit right on city borders, so double-check which city a property is actually in when doing your research.